In the early 1990s, the business and consumer world encountered a new way of doing business, called electronic payment. Over the years, e-commerce has become a popular and well-known way of making payments. The popularity and trend of telecommunication electronic payment services in the world today is constantly growing, and it is becoming an increasingly secure way of doing business.

It makes payment easier for users and saves a lot of time and money. Online shopping is very practical and popular. Moreover, more and more people are practicing it because it saves time.

However, online shopping carries a lot of risks, and for that reason many avoid it. The very thought of giving someone your card number is uncomfortable. As online shopping gains in importance, banks offer customers a virtual card as a secure online shopping service.

What is a virtual card?

it is about creating an additional credit card with new sensitive data (CARD NUMBER, VALIDITY PERIOD, AND CVV2 code). What makes it different from a classic credit or debit card is that, before making a purchase, the customer assigns the desired limit on the card, which, of course, cannot be higher than the limit on his credit card.

After you create the card, transfer the money from your “real” card to the virtual card and then the money is on the virtual card. Imagine that each card is one user account where you can keep the money.

Once you have transferred money you can use it to pay for services and items at those web shops that accept VISA cards. We have not yet found any store that has accepted VISA, that has not accepted this virtual variant. To learn more about the virtual card check the full article. There are many reasons why a virtual card is considered safe to use, and these are some of them.

You can’t lose it

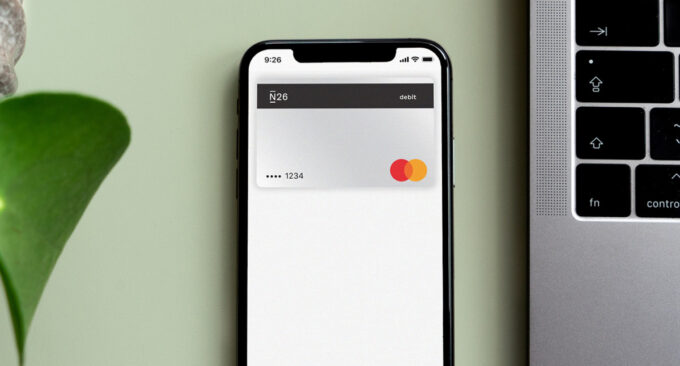

The name itself tells us that it is a virtual card, ie one that exists only in digital form. That’s why, you don’t have to worry about losing it, because you can’t! You have access to your card via a smartphone, and even if you lose it, there is little chance that someone could misuse it because it is protected by biometrics, while in a very short time, thanks to biometrics and the nature of virtuality, you will have your virtual cards back on the new phone.

You have limit

Given that this card is connected to your bank card, and that you can only dispose of and transfer to it the amount you own, and no more, we can say that it has a positive effect on customer security, especially because one user is allowed to have several virtual cards. This way you will protect your money when you buy and will not spend more than you planned.

3D secure standard

Thanks to the 3D secure standard, the virtual card contributes to significantly greater security and protection of customers when making online card payments. This secure system provides the highest level of security when shopping online.

The 3D Secure security standard is activated at the first correct identification in an online store that supports this standard. 3D Secure online card purchase brings a higher level of security, because every purchase confirms the authenticity of the card to its owner, by sending a one-time password via SMS or email.

Such a method represents an improvement in protection against unauthorized use of the card, both for the card user and for merchants who sell their products and services online.

How to get a virtual card?

It is very easy to get a virtual card. The first step you need to do is to create a card of the required denomination, that is, to give your card information to the bank where you want to open a virtual card. You will then receive a 16-digit number from the bank that will represent your virtual card number. It is up to you to decide how much money you will transfer from your credit card to the virtual one and the purchase can begin!

Validity of virtual cards

Although the bank’s policy may differ from one to another, the validity of these cards is very short and only one payment is allowed. It is usually a validity period of a day or two, although some banks allow longer.

What should I do with the money left in the account after the purchase? If you have transferred more money to the virtual account than you needed to buy, do not worry, because you can return it to your bank account.

Classic vs virtual card

To better understand the difference between a classic card and a virtual one, we compared these two payment instruments.

- When we talk about the security code that needs to be entered when shopping online, your three-digit number is clearly indicated on your debit card. On the other hand, if you buy using a virtual card, you will receive the code via SMS.

- While your debit or credit card number is clearly displayed on it, the virtual card number is displayed exclusively on your account.

- with a virtual card you spend only as much money as you have, not a dollar more.

- the classic card has a PIN code.

Final thoughts

Electronic payments offer flexibility for consumers who do not carry cash or buy online. People around the world take advantage of the trend method where they adopt a billing system for things they want and need. Innovation serves as a natural tendency to develop and use systems to achieve solutions to everyday tasks.

The development of electronic payment systems follows the available technology, which can achieve the desired outcome of accepting currency in exchange for goods. A biometric billing system can be cost-effective because it allows acceptance and makes a charge without any need to swipe the card or enter the PIN number.

When it is noticed that biometrics is completely unique for each person, this method The commercial billing system is generally recognized as much easier and quite affordable for those using this technology.