Online banking is a necessary tool for financial management. Quickly establish it to access your accounts easily and safely from anywhere with just a few clicks or taps.

In the hustle and bustle of modern-day living, the convenience and efficiency provided by online banking are simply indispensable. Setting up an online banking account is a very simple process. It can be completed in only a few steps. Keep reading to start your online banking journey and take control of your finances.

Step 1: Gather Information

Before setting up online banking, you need to allocate a significant amount of time to collecting comprehensive information about different banks’ policies and procedures. This process may entail examining the diverse types of accounts available, analyzing any possible charges for availing of online banking services, and understanding how you can access your account securely.

Reading through the bank’s terms and conditions thoroughly is indispensable as this helps prevent any future misunderstandings or unexpected costs. In addition to that, banks such as Varo Bank, who provide fee-free online banking with no monthly maintenance fees or minimum balance requirements, are worth looking into.

Step 2: Register for Online Banking

Once you have meticulously gathered all the necessary information regarding online banking, it’s imperative to register without delay. Fortunately, this process is straightforward and easily accomplished by visiting your bank’s website. You will be guided through each step of the new account registration via a series of prompts designed to ensure that you provide all required personal information accurately while verifying your identity as requested.

It’s critical to underscore the importance of selecting a robust and unforgettable password that can be effortlessly recalled but not so simple for others to guess. Your chosen password should reflect a complex combination of letters, numbers, and symbols that effectively protects your sensitive financial data from potential cyber threats or hackers with malicious intent.

Step 3: Download the Banking App

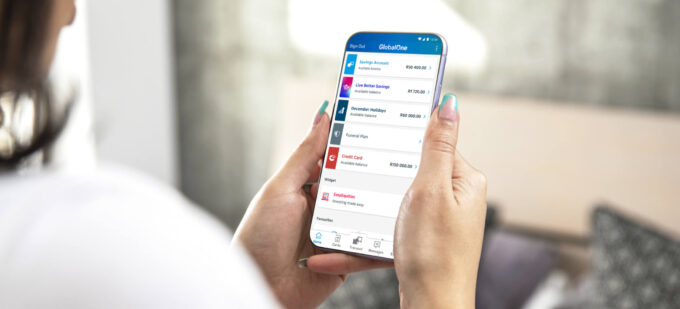

Once you have successfully registered for online banking, the subsequent crucial step is to fearlessly expand your horizons by downloading the bank’s cutting-edge mobile application on your state-of-the-art smartphone or tablet. The unparalleled convenience of being able to carry out seamless banking transactions while always on-the-go cannot be overstated enough. With this revolutionary app at your fingertips, you will gain access to an incredibly user-friendly interface that offers a myriad of secure features enabling easy account accessibility 24/7 from any corner of the world.

Experience sheer financial freedom like never before as you swiftly view your updated account balance in real-time and keep track of all monetary movements with utmost accuracy. Thanks to its lightning-fast processing speed, transferring funds between accounts or even sending money externally has now become quicker and easier than ever before – all thanks to this awe-inspiring application!

Step 4: Utilize the System Interface

In order to maximize the potential of internet banking and improve customer satisfaction, it is crucial to boldly extend the application of group-support system interface offered by majority of banks. This advanced platform functions as a streamlined mechanism that organizes cooperative design procedures while promoting innovation for gathering data on ideas.

By leveraging this innovative feature, customers can not only voice their concerns but also assist banks in identifying individual needs and preferences. Consequently, financial institutions can create personalized solutions tailored to meet each customer’s unique requirements accurately.

Harnessing the power of a group-support system interface is paramount in today’s digital age as it allows seamless communication between consumers and service providers while promoting collaboration towards building excellent user experiences.

How to choose Online Banking service for you

Choosing the right online banking service is an important decision that can greatly impact your financial management and security. Here are some key factors to consider when selecting an online banking service:

Security: Prioritize security features offered by the online banking service. Look for strong encryption protocols, multi-factor authentication, and fraud detection systems. Ensure the bank has robust measures in place to protect your personal and financial information.

User Experience: Evaluate the user interface and ease of navigation of the online banking platform. It should be intuitive, user-friendly, and provide a seamless experience for managing your accounts, making transactions, and accessing financial information.

Mobile Banking: Consider the availability and functionality of the mobile app. It should be compatible with your device, offer essential features, and provide a secure and convenient way to manage your finances on the go.

Services and Features: Assess the range of services and features offered by the online banking service. It should align with your banking needs, such as online bill payments, fund transfers, account alerts, budgeting tools, and integration with other financial apps.

Fees and Charges: Understand the fee structure associated with the online banking service. Review the charges for transactions, account maintenance, ATM usage, and any other applicable fees. Choose a service that offers transparent and reasonable fees that fit your financial requirements.

Customer Support: Evaluate the quality and availability of customer support. Ensure the online banking service provides responsive and helpful customer service through various channels, such as phone, email, or live chat, to address any concerns or issues you may encounter.

Reputation and Reviews: Research the reputation and reliability of the online banking service. Read reviews, check customer feedback, and consider the bank’s history and track record in providing secure and dependable online banking services.

Conclusion

Although some may find the idea of setting up online banking daunting, it can be easily achieved by following straightforward steps and utilizing bank-provided resources like mobile apps and group-support system interfaces. Thanks to real-time balance updates, fast fund transfers, personalized solutions, and other innovative features that come with it.

Online banking has transformed how we manage our finances making this once intimidating task more accessible than ever before. Therefore don’t miss out on experiencing its numerous benefits due to apprehension or unfamiliarity; embrace them instead!

Take the initiative to discover a reliable financial establishment that provides either internet-based banking solutions or exclusively operates through digital channels. Embrace the era of digitization and make online banking an indispensable component of your financial administration starting today!