Adding new tech to your IR platform can be daunting, as it often involves a steep learning curve. Many corporate offices cling to outdated apps simply because they’re familiar with the old, albeit bad, programs. However, digital acceleration in investor relations happens at lightning speeds. Dragging your heels on new innovations can put your entire IR program at risk.

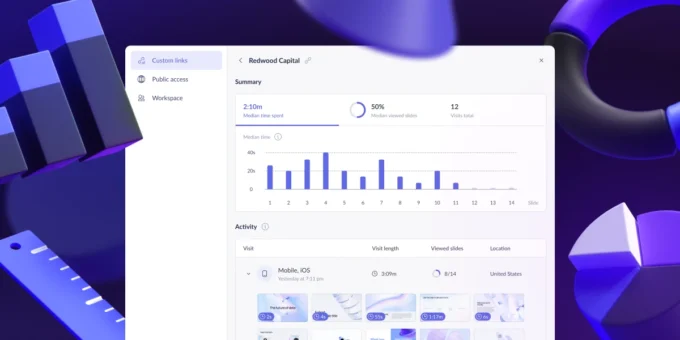

Sticking with what you know means you can’t take advantage of revolutionary new IR solutions, like engagement analytics. Engagement analytics is the latest aggregate from Q4 that collates investor activity from all your disparate IR tools, making it possible to compare them under one dashboard.

Fear of adopting new tech means you can’t take advantage of the insights or benchmarking made possible with engagement analytics. And that missed opportunity could cost your IR strategy significantly.

While adopting new tech isn’t without its challenges, new IR tools outweigh these possible drawbacks. Keep reading to learn why you shouldn’t let the fear of change stop you from upgrading your tools, plus how you can make it easier for your team to embrace these tools with greater ease.

The Challenges of Adopting New IR Technology

Adopting new IR technology can come with its fair share of hurdles. Here are some of the common barriers that convince many corporate offices that their current platform is good enough — even if they are outdated or glitchy.

Familiarity Bias

Familiarity bias is a psychological term used when people stick with familiar options over new ones, even if the unfamiliar option promises to be better. Your IR team may resist technological change, preferring to work with outdated processes they know, even if they complicate the workday. Fear of the unknown may be what’s holding them back; however, they may also worry that the new tech may increase their workload.

Learning Curve

Let’s be honest — mastering new software of any kind takes time and effort. The initial phase of onboarding and training can be frustrating for your team as they struggle to familiarize themselves with new tools and processes. This may be especially hard for Type-A individuals who like knowing all the answers, all the time.

Resistance to Change

Change can be met with resistance, especially if employees feel that their existing expertise and knowledge may become obsolete. Overcoming this resistance and ensuring buy-in from the team is essential for a smooth transition.

The Advantages of Adopting New Engagement Analytics

While the learning curve may present challenges, the benefits of adopting new IR technology can significantly outweigh the initial hurdles. Here’s why it’s worth the investment:

1. Data-Driven Decision Making

Engagement analytics gives you the tools to leverage actionable leading indicators that represent investor behavior, preferences, and sentiment. By harnessing this data, your team can make informed decisions and optimize your IR efforts to meet investor expectations.

2. Improved Efficiency

Modern IR software streamlines processes, automates repetitive tasks, and centralizes data management. This efficiency frees up time for IR professionals to focus on value-added activities and high-touch tasks with investors.

3. Enhanced Investor Relations

Engaging investors effectively is crucial for maintaining strong relationships. IR technology facilitates personalized communication, targeted outreach, and improved investor experiences. This, in turn, fosters trust, enhances investor satisfaction, and strengthens the overall reputation of the company.

4. Competitive Advantage

Embracing new technology sets companies apart from competitors still relying on outdated systems. By leveraging cutting-edge IR tools, companies demonstrate their commitment to innovation, attracting both investors and potential partners.

5. Mitigating Risks

New tech like engagement analytics can help identify potential risks and vulnerabilities by analyzing investor sentiment and feedback. By addressing these concerns proactively, you can enhance your risk management strategies and maintain investor confidence.

7 Simple Tips for a Smoother Transition

To minimize the learning curve and ensure a successful transition, consider implementing the following strategies:

1. Select User-Friendly Software

Choose IR software that prioritizes user experience and ease of use. Look for intuitive interfaces, comprehensive support, and gorgeous design. Opting for a solution that marries leading-edge technology with a user-friendly design can simplify the learning process for employees.

2. Invest in Training and Support

Allocate resources for comprehensive training sessions conducted by the software provider or experienced investor relations consultants. These sessions should be interactive, allowing employees to practice and reinforce the lessons they’ve learned in class. You should expect ongoing support and assistance from the provider or consultants in case any concerns arise during the learning process.

3. Provide Documentation and Resources

Support your team by providing detailed training materials and easy-to-follow instructions. Develop training packets that employees can refer to whenever they need guidance. These resources act as handy references, helping employees navigate the software effectively after the initial training period.

4. Assign a Technology Champion

Designate an individual or a team within the organization to become experts in the new IR technology. This “point person” can receive advanced training so they can act as a resource for others. They can troubleshoot issues, answer questions, and offer guidance, bridging the gap between employees and the new technology.

5. Foster a Culture of Learning and Adaptation

Encourage a growth mindset and emphasize the long-term benefits of the new technology. Celebrate successes and milestones achieved through its implementation. Recognize and reward employees who embrace the change and demonstrate proficiency in utilizing the IR software.

6. Communication and Collaboration

Establish a communication channel where IROs can share their experiences, challenges, and insights regarding the new technology. Encourage collaboration and create opportunities for cross-functional teams to work together, leveraging the new tools to enhance their collective effectiveness.

7. Gradual Implementation and Phased Rollout

If a sudden transition causes anxiety, consider a phased rollout approach. This allows employees to acclimate to the new technology gradually, reducing the impact of the learning curve. Start with a pilot group or department. You can gather feedback from them and make adjustments based on their concerns before expanding the tech to other people.

8. Continuous Learning and Professional Development

Encourage employees to pursue continuous learning and professional development opportunities related to the new IR technology. This can include attending webinars, conferences, or workshops focused on industry best practices, or leveraging online resources and communities to stay updated on the latest trends and developments. With their finger on the pulse, they might one day recommend a new app that your enterprise should adopt.

New Tech Promises Greater Efficiency and Insights

While the learning curve of adopting new IR technology may initially pose challenges, organizations can overcome them with the right approach. By choosing user-friendly software, providing thorough training and support, and fostering a culture of learning and adaptation, companies can streamline their IR efforts, enhance investor relations, and unlock valuable insights through engagement analytics.

Embracing new IR technology is an investment in the future, empowering organizations to stay ahead of the competition and foster meaningful connections with investors in the ever-evolving world of finance and investing.