Investing in real estate can be a great way to diversify your portfolio and build wealth over time.

Before investing in real estate, it’s important to learn as much as you can about the industry. Research different types of real estate investments, such as rental properties, REITs (real estate investment trusts), or house flipping, and understand the risks and rewards associated with each. Determine what you hope to achieve by investing in real estate. Are you looking for passive income, long-term appreciation, or a combination of both?

Decide how much money you are willing to invest and how you will finance your investment. Consider obtaining a mortgage or partnering with other investors to spread the financial risk. Research different markets and neighborhoods to find an area with good potential for appreciation and rental income.

Once you have identified a location, start looking for properties that fit your budget and investment goals. Consider factors such as the condition of the property, the potential for rental income, and the overall market demand. Before making an offer on a property, conduct thorough due diligence, including a property inspection, title search, and market analysis.

Once you own the property, be prepared to manage it. This may include finding tenants, handling maintenance and repairs, and managing rental income and expenses.

Investing in real estate requires careful planning, research, and a long-term outlook. By following these steps and seeking the guidance of a qualified real estate professional, you can make informed decisions and achieve your investment goals over time.

Rental Property

A rental property is a real estate investment that generates income by leasing the property to tenants. Rental properties can be a great investment opportunity, as they can provide both passive income and long-term appreciation potential.

Here are some key things to consider when investing in rental properties:

Location: Location is one of the most important factors when investing in rental properties. Look for properties in areas with high demand for rental housing, such as near universities, job centers, or transportation hubs.

Property condition: The condition of the property will affect its rental value and the amount of maintenance and repairs required. Consider the age and condition of the property, as well as any necessary repairs or upgrades.

Rental income potential: Research the local rental market to determine the potential rental income for the property. Look at similar properties in the area and compare their rental rates.

Operating expenses: Operating expenses for a rental property can include property taxes, insurance, maintenance, repairs, and property management fees. Be sure to factor in these expenses when determining the potential profitability of the investment.

Financing: Financing options for rental properties may include traditional mortgages, private loans, or partnerships with other investors. Consider the interest rates, terms, and fees associated with each option.

Tenant management: Managing tenants can be a time-consuming and challenging aspect of owning a rental property. Consider hiring a property management company to handle tenant screening, rent collection, and property maintenance.

Long-term outlook: Investing in rental properties is a long-term commitment, so be sure to consider your long-term investment goals and potential for appreciation over time.

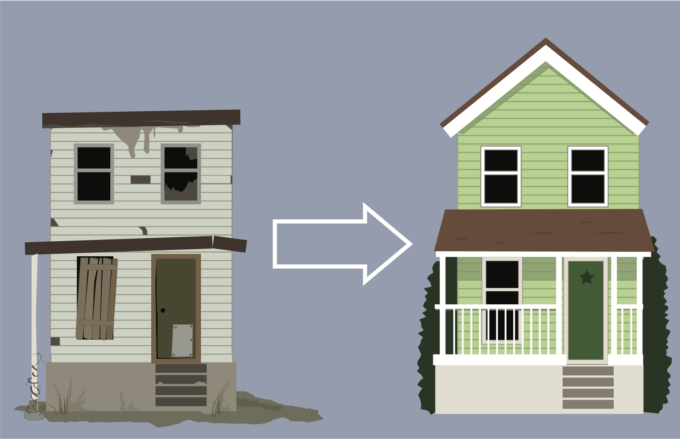

What is house flipping?

You may have heard this term, but didn’t know what it exactly means. So, house flipping is a real estate investment strategy in which an investor purchases a property, renovates it, and then sells it for a profit. The goal of house flipping is to buy low, invest in renovations, and then sell high.

Some basic steps involved in house flipping include:

Find a property

The first step in house flipping is to find a property that is underpriced and has the potential for a profitable renovation. Look for distressed properties, such as foreclosures or fixer-uppers, that are being sold below market value.

Renovate the property

Once the property is purchased, the investor will begin renovations. This may involve minor repairs or a complete overhaul of the property. The goal is to create a modern, updated, and attractive living space that will appeal to buyers.

Sell the property

Once the renovations are complete, the investor will list the property for sale. The goal is to sell the property quickly and for a profit.

Calculate profits

The final step is to calculate the profits from the sale. This will involve subtracting the purchase price, renovation costs, and any other expenses from the selling price. If the profits are high enough, the investor may consider reinvesting in another house-flipping project.

House flipping can be a profitable investment strategy, but it’s important to be aware of the risks and challenges involved. Renovations can be costly and time-consuming, and the real estate market can be unpredictable.

Real estate investment groups (REIGs)

Another term which is very important to know when investing in Real Estate Investment Groups (REIGs). It is a type of real estate investment that allows individuals to pool their money together to purchase and manage rental properties. REIGs are typically formed as limited liability companies (LLCs), and members can invest in the company and become partial owners of the properties within the group.

Key benefits of investing in REIGs:

Passive investment

REIGs allow investors to own rental properties without having to manage them directly. The group will typically hire a professional property management company to handle day-to-day operations, such as tenant screening, rent collection, and maintenance.

Diversification

REIGs offer investors the opportunity to diversify their real estate investments across multiple properties and locations, which can reduce risk and increase potential returns.

Professional management

By hiring a professional property management company, REIGs can benefit from the expertise of experienced professionals who have the knowledge and resources to manage properties effectively.

Lower barrier to entry

Investing in an REIG can be a more affordable way to get into the real estate market, as investors can pool their money together to purchase properties that may be out of reach for individual investors.

Potential for income and appreciation

REIGs can generate income through rental payments and may also appreciate over time, providing investors with both short-term and long-term returns.

As with any investment, there is the potential for financial loss, and the success of the investment will depend on factors such as the performance of the real estate market, the quality of the properties purchased, and the effectiveness of the property management company. Additionally, as a partial owner of the REIG, investors may have limited control over the day-to-day operations and decision-making processes of the group.

Overall, REIGs can be a viable investment option for individuals who want to own rental real estate without the hassles of managing it directly. It’s important to do your research, seek the guidance of a qualified real estate professional, and carefully consider the risks and rewards before investing in an REIG.

If you are interested in real estate investment in Dubai, check our website Mayak. ae and find the best offers.