Especially in the current climate where savings accounts are failing to keep pace with inflation, playing the market is an attractive course of action to make the most of your money. However, to give you the best chance of success, it’s important to understand the pitfalls and best practices of trading before you jump in.

What is trading?

Trading is the buying and selling of financial assets such as forex, stocks, bonds, and commodities. It differs from investing in terms of timescale: trading is fast-paced with a view to quick returns while investing is a slower strategy that hopes to lead to long-term gains.

The trading landscape is always fluctuating, sometimes significantly over a short space of time. Traders must be vigilant in spotting when to sell their stocks and shares before the market turns or they risk making a loss on their purchase.

While there is always an element of risk with trading it can be an effective way to boost funds, and there are steps you can take to safeguard your money and improve your chances of making a profit.

Top tips for a profitable portfolio

Understanding currency pairs

Known as foreign exchange (forex) trading, the practice of buying one currency with another offers opportunities to profit from shifting exchange rates. The idea is to sell your purchased currency when the exchange rate is most lucrative, thus getting back more than your initial investment.

Understanding currency pairs is vital to identifying good opportunities and protecting your money. The most popular pairs are EUR/USD, USD/JPY and GBP/USD, considered to be stable due to the size of the markets. Exotic pairs from countries with a smaller economy are more volatile.

It’s best to begin by trading the major currency pairs before you move into anything more high-risk.

Diversification

The age-old saying ‘don’t put all your eggs in one basket’ is one to remember when it comes to trading. Rather than sinking your funds into one venture, strive for success with a wide range of trades. This strategy is known as the diversification of your portfolio, and it helps to protect you against unpredictable events like sudden downturns in the market.

You can use online tools such as the Tradu trading platform to explore a wide range of trading opportunities, constantly monitor your portfolio and buy and sell at the most profitable moments. An ideal portfolio would include different types of assets from new and established companies across several industries.

Risk management

Given the changeable nature of the financial markets, you can’t trust that your trading ventures will stay steady – even in the short term. Taking steps to mitigate risk will help to minimise the chances of making a loss.

Look into avenues such as stop-loss orders which dictate that the stock must be sold when it reaches a set low or high price. This can limit profit but should protect you against substantial losses.

You should also keep careful track of your overall portfolio to ensure you’re in the black and spot unprofitable endeavours before they can cause long-term damage.

Psychological Aspects of Trading

Trading is not just about strategies and market analysis; it’s also a test of emotional resilience. Successful traders often possess the ability to manage stress, maintain discipline, and keep their emotions in check, especially during market volatility. The psychological aspect of trading involves overcoming fear and greed, two emotions that frequently lead to hasty decisions and potential losses.

Developing a mindset that accommodates the inevitable ups and downs of trading can lead to more rational decision-making and improved outcomes. Techniques such as mindfulness, setting realistic goals, and maintaining a balanced lifestyle can help traders navigate the emotional rollercoaster of the markets.

Continuous Education in Trading

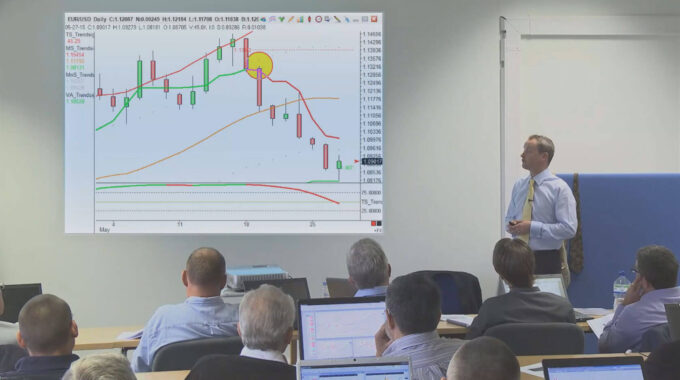

The financial markets are dynamic, with constant fluctuations influenced by global events, economic reports, and technological advancements. For traders, continuous education is vital to stay ahead. This involves not only keeping abreast of current market trends and news but also committing to a lifelong learning process that includes studying market theories, trading strategies, and financial instruments.

Engaging with trading communities, attending webinars, and enrolling in courses can provide fresh insights and foster a deeper understanding of market behaviors. An informed trader is better equipped to adapt to market changes and make well-considered decisions.

Understanding Technical and Fundamental Analysis

Technical and fundamental analysis are cornerstone techniques in trading, each offering a different lens through which to assess potential investments. Technical analysis focuses on price movements and trading volumes to forecast future trends, using charts and various indicators like moving averages and relative strength index (RSI).

In contrast, fundamental analysis delves into the intrinsic value of an asset, considering economic indicators, company earnings, industry conditions, and other macroeconomic factors. Mastering these methods can provide traders with a comprehensive view of the market, enabling them to make more informed decisions and identify lucrative trading opportunities.

The Risks and Mechanics of Leverage

Leverage is a double-edged sword in trading, amplifying both profits and losses. It allows traders to open larger positions with a relatively small amount of capital, potentially increasing returns on investment. However, the increased exposure also means that market movements can have a proportionally larger impact on the trader’s capital, potentially leading to rapid losses. Understanding the mechanics of leverage, including how to calculate leverage ratios and the implications for margin requirements, is crucial. Traders must also be aware of the risk management strategies needed to mitigate the potential downsides of using leverage.

Navigating the Regulatory Environment

The regulatory environment for trading varies significantly across different jurisdictions and financial instruments. Regulations are designed to protect investors, ensure market fairness, and prevent financial crimes. Traders must familiarize themselves with the rules and regulations applicable to their trading activities, including registration requirements, reporting obligations, and compliance standards.

Ignorance of the law is not a defense, and failure to comply can result in severe penalties, including fines and trading restrictions. Staying informed about regulatory changes and understanding the legal landscape can help traders avoid legal pitfalls and trade with confidence.

Closing Thoughts

In conclusion, trading in the financial markets extends beyond mere buying and selling of assets. It demands a comprehensive understanding of various facets, including the psychological challenges traders face, the importance of continuous education to adapt to ever-changing market dynamics, and a deep dive into analytical tools like technical and fundamental analysis.