In the world of modern finance, electronic payments have become the norm. From receiving your paycheck to paying bills and even making online purchases, electronic transactions are an integral part of our daily lives. At the heart of this digital financial ecosystem lies the Automated Clearing House (ACH) Direct Deposit system. In this comprehensive guide, we will delve into the intricacies of ACH Direct Deposit, its significance, and how it powers the electronic payment landscape.

Introduction

In a world that is increasingly going cashless, understanding the mechanisms behind electronic payments is essential. ACH Direct Deposit is a fundamental component of this electronic payment infrastructure, often working behind the scenes to facilitate various financial transactions. From receiving your salary directly into your bank account to setting up recurring bill payments, ACH Direct Deposit plays a pivotal role through a nacha file format.

This article aims to provide you with a comprehensive understanding of ACH Direct Deposit, including its definition, operation, benefits, and its role in the broader financial landscape. Whether you are an employee, an employer, a business owner, or simply an individual looking to streamline your financial processes, grasping the nuances of ACH Direct Deposit will empower you to make informed financial decisions.

What is ACH Direct Deposit?

They often referred to simply as Direct Deposit, is a secure and convenient electronic payment system used for transferring funds from one bank account to another. Unlike traditional methods of payment, such as paper checks, ACH Direct Deposit eliminates the need for physical transactions, making it faster, more efficient, and environmentally friendly.

This payment method is typically used for:

- Payroll: Employers use ACH Direct Deposit to pay their employees’ salaries directly into their bank accounts, eliminating the need for physical paychecks.

- Government Benefits: Federal and state governments use ACH Direct Deposit to distribute benefits, such as Social Security payments and tax refunds.

- Vendor Payments: Businesses can use ACH Direct Deposit to pay suppliers, vendors, and contractors.

- Recurring Payments: They allows individuals to automate recurring payments, such as mortgage or utility bills, ensuring timely payments without manual intervention.

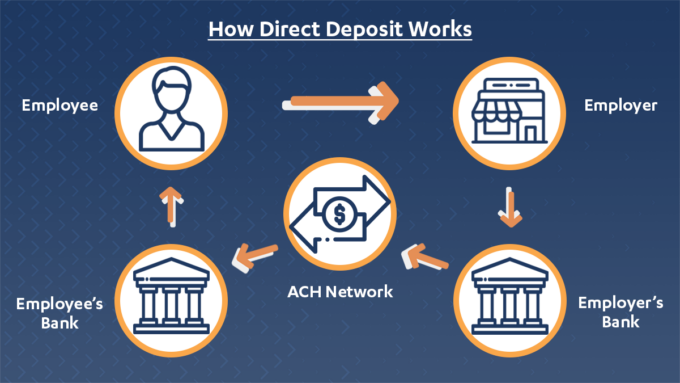

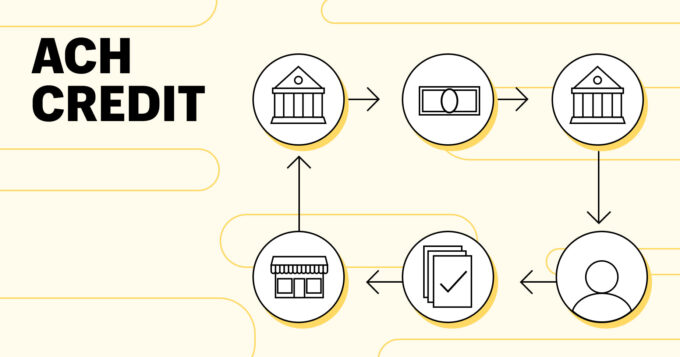

How ACH Direct Deposit Works

Understanding the mechanics of ACH Direct Deposit is crucial to grasp its significance in the electronic payment ecosystem. Here’s a simplified overview of how it works:

- Authorization: To initiate an ACH Direct Deposit, the sender (often referred to as the Originator) must obtain authorization from the recipient (Receiver). This authorization can be in the form of a signed agreement or an online authorization process.

- Originator’s Bank: The Originator initiates the payment by providing their bank with the necessary information, including the recipient’s bank account number, routing number, and the amount to be transferred.

- Originating Depository Financial Institution (ODFI): The Originator’s bank, known as the ODFI, forwards the payment request to the ACH network. The ACH network acts as an intermediary that facilitates the transfer.

- ACH Network: The ACH network processes the payment request and ensures that it meets the necessary criteria, such as valid account numbers and sufficient funds. If the transaction is approved, it proceeds to the next step.

- Receiving Depository Financial Institution (RDFI): The ACH network forwards the approved transaction to the recipient’s bank, known as the RDFI.

- Recipient’s Account: The RDFI deposits the funds into the recipient’s bank account, making them available for withdrawal or use.

- Notification: Both the Originator and the Receiver receive notifications confirming the successful completion of the transaction.

It’s important to note that transactions are not processed in real-time like some other payment methods, such as credit card transactions. Instead, they are typically batched and processed in predefined cycles, which can vary depending on the type of transaction and the financial institutions involved. This batch processing helps reduce costs and streamline the transfer of funds.

Benefits of ACH Direct Deposit

Now that we have a clear understanding of what ACH Direct Deposit is and how it works, let’s explore the various benefits associated with this payment method:

4.1. Speed and Efficiency

One of the primary advantages of ACH Direct Deposit is its speed and efficiency. Unlike traditional paper checks, which can take several days to clear, ACH transactions are processed relatively quickly. Typically, funds are available in the recipient’s account within one to two business days. This speed is especially crucial for employees who rely on their paychecks to cover expenses promptly.

4.2. Cost-Effective

ACH Direct Deposit is a cost-effective payment solution for both businesses and individuals. Businesses can save money on printing and mailing paper checks, while individuals can avoid check-cashing fees often associated with paper checks. This cost-efficiency makes it an attractive option for employers and financial institutions alike.

4.3. Security

Security is a paramount concern in the world of electronic payments, and ACH Direct Deposit is no exception. ACH transactions are subject to strict security protocols and encryption standards to protect sensitive financial information. Additionally, the authorization process ensures that only authorized transactions are processed, reducing the risk of fraudulent activity.

4.4. Automation and Convenience

For both businesses and individuals, ACH Direct Deposit offers the convenience of automation. Employers can set up recurring payroll deposits, ensuring that employees receive their salaries on time without the need for manual intervention. Individuals can also automate bill payments, helping them avoid late fees and penalties.

4.5. Environmental Impact

In an era where environmental sustainability is a significant concern, ACH Direct Deposit stands out as an eco-friendly payment option. Reducing the need for paper checks, it helps decrease paper waste and the carbon footprint associated with printing and mailing physical checks.

4.6. Accessibility

ACH Direct Deposit is accessible to a wide range of individuals and businesses. It is not limited by geographical boundaries or physical presence, making it suitable for remote workers, freelancers, and businesses with a global presence. This accessibility contributes to its widespread adoption.

Security Measures

Security is a top priority in the world of electronic payments, and the ACH Direct Deposit system is no exception. To ensure the safety of transactions, several security measures are in place:

5.1. Authorization

Before initiating an ACH Direct Deposit, the Originator must obtain explicit authorization from the Receiver. This authorization can take the form of a written agreement, an electronic signature, or an online authorization process. Without proper authorization, a transaction cannot proceed.

5.2. Encryption

All data transmitted during an ACH transaction is encrypted to protect it from unauthorized access. Advanced encryption protocols ensure that sensitive information, such as bank account numbers and transaction details, remains secure during transmission.

5.3. Authentication

To prevent fraudulent transactions, ACH Direct Deposit transactions require multi-factor authentication. This includes verifying the authenticity of the sender and ensuring that the transaction details match