Running a small business successfully requires the efficient management of finances. This process can consume significant time and resources, becoming overwhelmingly complex with spreadsheets all over the place. Fortunately, technological advancements have brought us excellent financial management software tools. These tools are specifically designed to streamline accounting operations, manage budgets, analyze financial performance, and simplify overall financial management for small businesses.

However, even with these tools, some businesses require more strategic financial advice and expertise, hence the rising trend of turning to a fractional CFO firm, which offers the services of experienced Chief Financial Officers on a part-time or as-needed basis to small businesses. This means that these businesses can now have access to high-level financial management and analysis usually reserved for larger corporations. Below are eight of the best financial software tools for small businesses:

1. QuickBooks Online

QuickBooks Online is one of the most popular financial management tools for small businesses. It offers an intuitive interface and powerful features that cater to small businesses in diverse industries. The platform provides a complete package, from receipt capturing and expense tracking to integrated payroll services and tax preparation capability.

Small businesses can create custom, professional invoices, track sales and expenses, manage accounts payable and receivable, and even have real-time visibility into their financial health. QuickBooks Online offers integration with other business applications, including customer relationship management (CRM) and ecommerce platforms, enhancing its functionality and flexibility.

2. FreshBooks

FreshBooks is an excellent tool renowned for its robust features, affordability, and ease of use. This cloud-based software is specifically designed for small businesses, particularly those offering services. FreshBooks offers comprehensive invoicing features, including the ability to accept credit card payments with competitive fees, enabling businesses to get paid faster.

In addition, FreshBooks provides time and expense tracking, financial reports, and automated payment reminders for overdue invoices. Its tax time reports feature is a gem for the tax season, allowing users to create Profit and loss and Sales Tax Summary reports with ease. The platform’s friendly usability eases the financial management process, giving business owners more time to focus on core operations.

3. Zoho Books

Zoho Books is part of Zoho’s extensive suite of business applications. Despite being incredibly affordable, it doesn’t compromise scalability and flexibility. The lower price point makes Zoho Books particularly attractive to solopreneurs, startups, and small businesses.

Zoho Books comes well-equipped with features, including cash flow statements, P&L, Balance sheets, invoicing, bills and expenses, inventory management, and online collaboration with customers. Its automatic bank feeds, interactive dashboard, and data imports make it stand out among competitors. Plus, its minimalistic and efficient user interface reduces the steep learning curves often associated with financial management tools.

4. Wave

Wave is a free financial management software that’s a great fit for freelancers, solopreneurs, and small businesses on a tight budget. Despite the free entry point, Wave doesn’t skimp on features. It includes online invoices, expense tracking, receipt scanning, and basic reports.

Wave’s standout feature perhaps is its ability to allow unlimited collaborators, which is perfect for businesses with multiple partners. Although Wave doesn’t offer comprehensive features like QuickBooks or FreshBooks, its free usage policy certainly makes it an appealing choice for small businesses needing basic accounting tools.

5. Sage 50cloud

Sage 50cloud is a comprehensive financial management solution that combines desktop functionality with cloud accessibility. This hybrid approach ensures that small businesses have the flexibility to work both online and offline. Sage 50cloud offers a robust set of features, including invoicing, inventory management, and advanced financial reporting.

One standout feature of Sage 50cloud is its strong focus on compliance and security. The software helps businesses adhere to regulatory requirements and maintain the confidentiality of sensitive financial data. With bank-level security and regular updates to accommodate tax changes, Sage 50cloud provides peace of mind to small business owners. Additionally, the software supports seamless collaboration with accountants and integrates with popular Microsoft 365 applications, enhancing productivity and communication within the business.

6. Xero

Xero is a cloud-based accounting software solution that has gained popularity for its comprehensive features and scalability. Xero offers small to medium-sized businesses tools for invoicing, expense tracking, payroll, and bank reconciliation. The platform’s real-time collaboration capabilities make it easy for business owners, accountants, and advisors to work together seamlessly.

Xero stands out for its strong emphasis on automation, helping businesses save time and reduce manual errors. The software integrates with numerous apps, allowing users to customize their financial management processes based on their unique needs. With multi-currency support and the ability to handle complex accounting tasks, Xero is an excellent choice for small businesses with aspirations for growth and international expansion.

7. SlickPie

SlickPie stands out as an accessible and budget-friendly financial management solution designed specifically to meet the needs of small businesses and freelancers. Operating on the cloud, this accounting software provides essential functionalities like invoicing, expense tracking, and financial reporting. What distinguishes SlickPie is its commitment to simplicity and accessibility, positioning it as an excellent option for entrepreneurs lacking an extensive background in accounting.

SlickPie’s intuitive interface allows users to manage their finances with ease, and it offers automation features to streamline repetitive tasks. The software also provides secure online invoicing and supports multiple currencies, catering to businesses engaged in international transactions. As a cloud-based solution, SlickPie ensures that users can access their financial data from anywhere, promoting flexibility and efficiency for small business owners on the go.

8. NetSuite

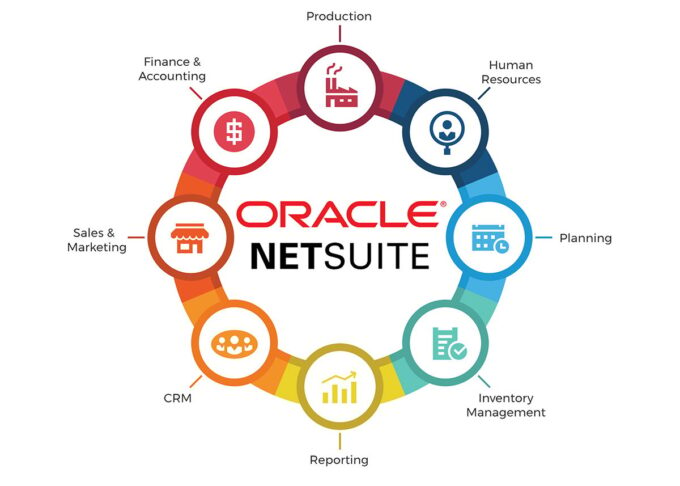

NetSuite emerges as a robust and all-encompassing cloud-based financial management software uniquely positioned to cater to the evolving needs of small businesses. While traditionally associated with larger enterprises, NetSuite’s scalability makes it an excellent choice for small businesses with aspirations for growth.

One of NetSuite’s standout features is its integrated approach, seamlessly combining financial management with customer relationship management (CRM), inventory management, and e-commerce functionalities. This holistic integration empowers small businesses to streamline their operations, foster collaboration between departments, and gain a unified view of their business processes.

NetSuite’s advanced reporting and analytics tools also equip decision-makers with real-time insights, enabling data-driven decision-making for increased agility in today’s competitive business landscape.

Endnote

Selecting the ideal financial management software for your small business can dramatically change your financial management approach. It can save you time, help you stay organized, and gain clear insights into your financial health. QuickBooks, FreshBooks, Zoho Books, SlickPie, Xero, NetSuite, and Wave are all worthwhile considerations, and they all offer unique strengths.

Look closely at what your small business needs and compare it against the features and pricing of these software tools. The right tool will ultimately depend on your business’s specific requirements and budget.