Credit scores are an extremely important aspect of many people’s lives. Because of this, it is of crucial importance to understand what they are and how they work. This way, you will have all the tools you need to improve them and live a more rewarding financial life.

In this article, you can find a short but useful debunking of credit scores. First of all, you will find a definition of what they are, followed by a simple explanation of the way they function. The second part of this article will be devoted to ways useful to improve them. But start simply by understanding what they are.

What Are Credit Scores?

Credit scores can be defined as predictions of one’s credit behavior. For example, a credit score could try to guess how likely you are to pay a loan back on time. These types of scores are based on various factors, but one of the most important sets of information can be found in your credit reports.

Companies hold credit scores in high regard. They used them as hints of your reliability as a consumer and as a financial entity. Companies can also use these scores to make important decisions on whether or not you should get a mortgage, a credit card, an auto loan, or even other credit products. Besides, these scores are also useful to determine the interest rate, as well as the credit limit you will receive.

Now that you know more about what credit scores are, you might be wondering how they work. Well, normally, companies can use a mathematical formula, usually called a “scoring model”, which is used to create your credit score from the information given by your credit report.

How Does Credit Score Work?

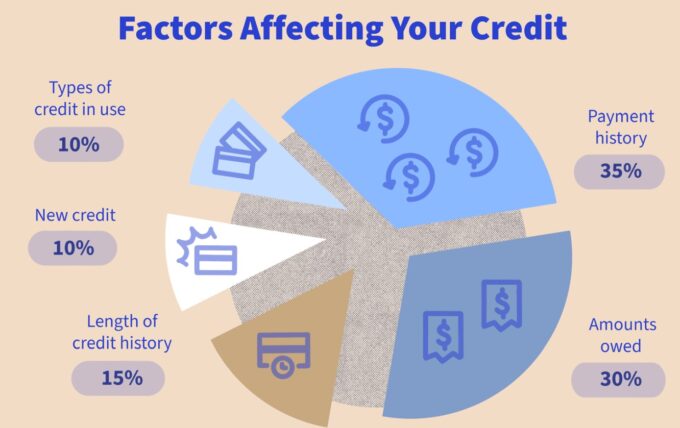

You now know that credit scores can be calculated using a mathematical formula, but what’s truly interesting to know is what factors have the power to impact your credit score. These factors will be then taken into account by the formula, and therefore, it is useful to know about them, so to readjust your spending habits and your financial routine to improve your credit score.

Your bill-paying history is one of the factors that you should take more into account when trying to improve your credit score. They work as a history of your spending habits and therefore, they can speak volumes about your reliability as a financial entity. But that’s not all; many other factors should be considered.

These factors are various and include your current unpaid debt (which should be paid in the process of improving your credit score), the number and type of loan accounts you possess and how long they have been open. Additionally, you should also consider how much of your available credit you are currently using (and for what) and any potentially problematic factors such as past bankruptcy or foreclosure.

Worry not; everyone has some skeletons in their closets and every person on the planet could tell you all about their financial mistakes. The point is not to be perfect but to improve your credit score and in the next section, you can learn how.

How To Improve Your Credit Score?

The first and most important thing to do when in the process of improving your credit score is to prove where you live. This might sound odd at first, but registering at your current address already makes you a more reliable financial entity. As this is the era of the digital revolution, you should also get all the help you can from some reliable platforms, such as MetaTrader 5, which can be a great ally in your journey to financial stability.

Building your credit history can be another way to improve your credit score. It is very difficult for companies to assess a specific person if they do not have any credit history. This is a very common problem, most of all for young people and this can be fixed by building your credit history day by day.

Speaking of this, a way to build a great credit history is to make regular payments on time. This not only can be traced due to their regularity, but it also shows that you can stick to a schedule and that you will, therefore, be able to pay any kind of mortgage or loan you will get. As people say, facts speak louder than words.

Paying regular payments on time is a wonderful way to go, but you should also pay attention to your credit utilization and make it as low as possible. With the term “credit utilization,” people refer to the percentage you use of your credit limit. A lower percentage will be seen positively by any company or lender and it will increase your credit score as well! Two pigeons with one stone.

Ideally, you should aim to keep your credit score as low as below 30%. In some cases, people can also get an instant score boost, but this can only be done with specific companies or thanks to specific advisors. For now, using all the aforementioned methods should do the trick.

In Conclusion

This article told you all about credit scores. It started by telling you what they are and how they work and finally, it gave you some tips on how to improve your credit score situation. From regular payments to low credit utilization, there are several things you can do to improve your financial situation.

It is worth saying though, before taking any steps, that every adult out there is learning about finance in their own time and that no one outside of this industry will have a perfect knowledge on this matter. On the other hand, it is easy to get accustomed to some of the best practices out there and it is even easier to implement them into your financial routine. Stick to payments and do not overspend if you can’t do so at the moment. Things will soon look up!