Annuities, a type of insurance product, often evoke a range of emotions from investors. They can be a puzzling financial instrument to navigate, wrapped up in a cloak of complexity and misunderstanding. This comprehensive guide aims to demystify annuities, providing a thorough understanding of their workings, benefits, and potential risks. By illustrating their intricacies in a clear, uncomplicated manner, this guide equips investors with the knowledge and confidence to make informed decisions about incorporating them into their financial plans.

Annuities explained

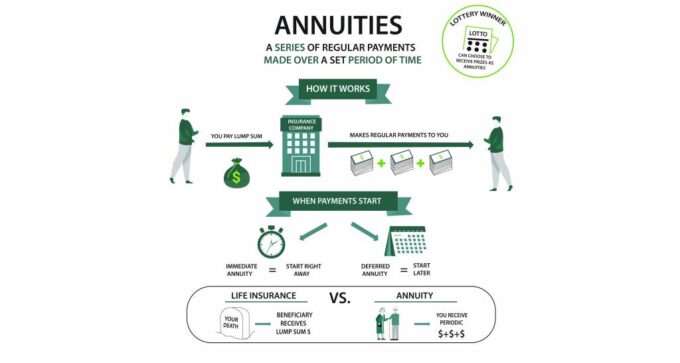

Annuities are prevalent contractual agreements between an individual and an insurance company. The individual can make a lump-sum payment or a series of payments in these agreements. In return for these payments, the insurer promises to make periodic payments to the individual. These periodic payments can be a valuable source of income, providing financial security and stability for the individual.

Annuities allow individuals to plan for their future and ensure a steady income stream when they retire or other specified periods. By entering into an annuity contract, individuals can effectively manage their financial resources and enhance their financial well-being in the long run.

Types of Annuities

Regarding annuities, there are primarily two types to consider: Immediate and Deferred. Immediate annuities benefit from starting payments right after the purchase, ensuring immediate financial support. On the other hand, deferred annuities allow for the accumulation of funds over time, providing a nest egg for a future payout.

It’s important to note that each type can be further categorized as Fixed, offering a guaranteed return, or Variable, where the payout is based on market performance. These options allow individuals to tailor their annuity choices to align with their financial goals and preferences.

Benefits of Annuities

Annuities offer numerous benefits, with one of the key advantages being income security during retirement. By providing a steady stream of funds that can last a lifetime, annuities are a reliable safety net, ensuring financial stability and peace of mind during one’s non-working years.

With their flexibility and customizable options, annuities empower individuals to tailor their retirement income to their needs and goals. Whether supplementing other sources of retirement income or serving as the primary source, annuities offer a comprehensive solution that can adapt to changing circumstances and provide financial security for the future.

Risks and Downsides

While annuities can be valuable in ensuring income sustainability, they must be aware of their potential risks. In the case of variable annuities, investors should consider factors such as high fees, limited liquidity, and exposure to investment risks. These downsides highlight the need for thorough evaluation and understanding before committing to such financial products.

The Best Annuities Available

The allianz benefit control annuity, the Lincoln Financial Pension Protector Annuity, and the Pacific Life Foundation Elite Fixed Index Annuity are widely recognized as some of the best annuities available today. These versatile financial products offer diverse features, including flexible payout options, guaranteed income streams, and potential for growth tied to market indexes.

With the ability to customize retirement income preferences and goals while effectively mitigating risks, these provide investors with a comprehensive solution to secure their financial future.

Making an Informed Decision: Questions to Ask Before Investing in Annuities

When incorporating an annuity product into your overall financial plan, it’s crucial to consider several key factors. Firstly, understanding the fees associated with the product and comparing them to other annuities in the market can provide valuable insights into cost-effectiveness. Additionally, you must inquire about any surrender charges that may apply if you decide to cash out early.

Tax implications are another aspect to consider before investing in an annuity. Familiarizing yourself with the potential tax consequences can help you make informed decisions aligned with your financial goals.

Exploring the different types of payouts available and determining which ones best suit your needs is essential. Whether you prefer a fixed payout, variable payout, or any other option, selecting the most suitable payout structure is crucial for financial security.

Considering the presence of a death benefit in the annuity is also crucial. This feature can provide your beneficiaries an added layer of financial security, ensuring their well-being even after you’re gone.

It’s worth inquiring about adding riders to the annuity contract. These riders can offer additional benefits, such as long-term care coverage or enhanced death benefits, which can further customize the annuity to meet your specific requirements.

Investors can make more informed decisions by asking these critical questions and seeking detailed answers when contemplating an annuity investment. This knowledge empowers individuals to demystify annuities, take control of their financial future, and ultimately select the product that best aligns with their unique needs and goals.

Bottom Line

Annuities hold the potential to provide a reliable income during retirement, offering a sense of security and peace of mind. However, it’s important to note that annuities are not a one-size-fits-all solution. Each individual’s financial situation and goals should be carefully considered before deciding.

Investors must take the time to thoroughly understand the intricacies of annuities, including the different types available, the potential benefits they offer, and the possible pitfalls to watch out for. By doing so, they can make a well-informed choice that aligns with their overall investment strategy and long-term financial objectives.

Demystifying annuities is the first step towards leveraging their full potential. Individuals can confidently move forward by understanding how annuities work and their role in a comprehensive retirement plan, ensuring a financially secure future.