The insurance industry has evolved rapidly with the help of transformative technologies. Digital transformation has driven insurers to take the shift, demonstrating how it has positively revolutionized other commercial industries like healthcare, retail, manufacturing, and hospitality.

Moreover, the insurance industry is customer-centric. With the promise of providing more accessible information, accuracy, efficiency, and enhanced carrier-customer interaction, insurers have fully embraced the innovations covered in this guide.

Here is a comprehensive reference to help you understand how these technologies would revolutionize the insurance business.

Internet of Things (IoT)

IoT enables everyday objects to send and receive data through the interconnection via the internet of computing devices embedded in them. These devices include security cameras, mobile gadgets, lamps, speakers, washing machines, wearable devices, and extensive business equipment.

Well, smart homes have fully embraced IoT with a huge connected cloud, connecting our entire lives. Meanwhile, insurers can use IoT and see business improvements through smarter data. Initially implemented in the Property and Casualty segment, insurers can remotely gather data and analyze performance as policyholders drive. This way, underwriters can close claims more efficiently with improved pricing and loss adjustment ratio.

This also makes healthcare insurance claims transparent. Insurers can collect data from health monitoring devices for claim operations and underwriting. They can track even specific details like websites that the clients have visited.

For instance, insurance can possibly check if they have been coming to sites like BuzzRX discount site and looking through the medicines, besides the limited medical records they can obtain through your permission.

In addition, insurers can also use IoT to build a seamless omnichannel experience using IoT sensors. Thus, they can offer services and products that the clients want by analyzing their buying behavior and other buying patterns.

Artificial Intelligence (AI) and Machine learning (ML)

AI is used by businesses to build smart machines and operate tasks with the integration of human intelligence. Meanwhile, ML refers to the type of AI that analyzes data and applies the learning without the intervention of human intelligence. Both are used to automate business processes like communication, reading and issuing documents, and performing back-room operations, among other time-consuming tasks that are mostly repetitive.

In the insurance industry, there are many uses of AI and ML. For instance, in auto insurance, when a client initiates a claim over the phone and online, they must wait for the adjuster to assess and provide the estimate for the damages to the car. The process involves the adjuster checking the vehicle, looking at the losses and defects, and providing the estimate, which could take days to complete.

However, with AI, policyholders can just take photos of the damaged car and send it to the insurers. Afterward, the AI algorithm will take care of the assessment and render an estimate within seconds. This way, there will be no time wasted waiting for the adjuster, allowing insurers to provide the needed funds to the policyholder to repair the damages without delay.

Blockchain Technology

Fraud detection and data integrity have been two of the most crucial concerns in the insurance industry. The type of data transmitted across networks within insurance businesses are favorite targets of hackers. This is where blockchain technology enters the picture. It is an immutable digital ledger that records and tracks digital transactions, ensuring the data are impenetrable and secured from unauthorized access.

Blockchain technology guarantees clients, insurers, stakeholders, and underwriters that all the data circulated through communications will remain uncompromised within the insurance ecosystem.

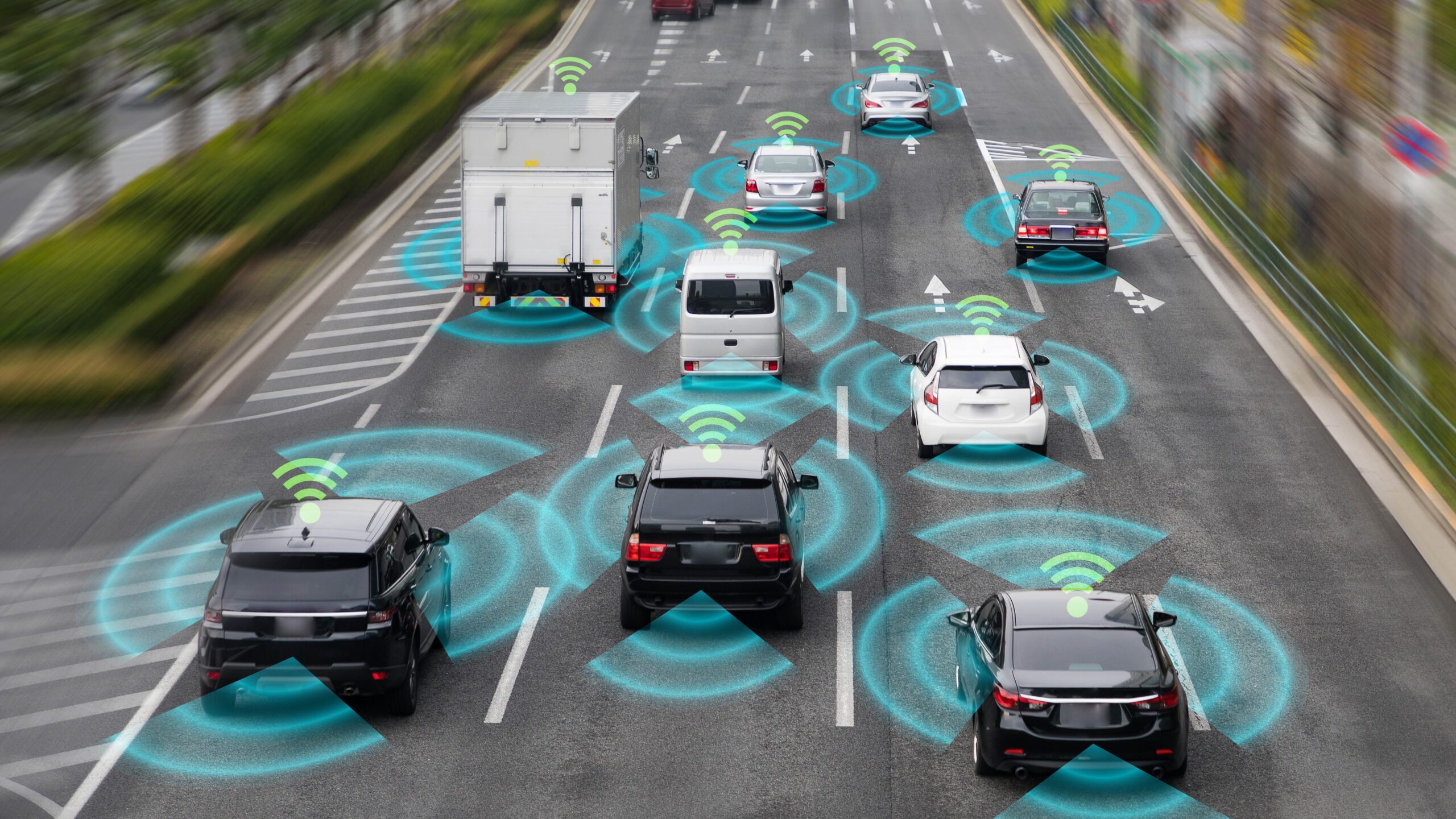

Telematics

Telematics is used by auto insurance companies to monitor and record driver’s habits, helping them come up with individual premium costs. The primary factors and data to be collected include speeds, driving distances, and locations. This way, insurers can determine aggressive drivers and those who drive more miles and charge them higher premiums. Conversely, those with positive driving habits will likely be charged lower premiums.

Drones

Insurers are also using drones to assess damages and even cancel insurance policies. After home insurance claims are filed, drones will be sent to properties to survey the area and take pictures of hail, wind, or storm damage.

This will cross out roof inspectors from the equation. Drones are specifically beneficial in locations inaccessible to humans, especially during storms. This technology can capture damages from dangerous and impractical areas that humans can’t possibly perform.

Social Media

More and more policyholders are using social media. With the rise of chatbots, email, and top-rated social media platforms, policyholders and potential clients won’t have to wait for calls and get answers when they want to avail of a new policy or modify their existing coverage.

The conventional way of communication using phones could take weeks to complete, but with online messaging, policyholders can now get quick responses to their urgent concerns about changing deductibles, updating addresses, or filing claims, among many other transactions.

Emerging Technologies in Insurance

The insurance sector is undergoing transformational change, with technologies like IoT, AI, and blockchain already reshaping industry contours. However, focusing solely on current technologies blinds us to the innovative horizon ahead, teeming with opportunities and advancements that promise to redefine insurance paradigms.

AR & VR

AR and VR stand out as transformative tools, refining customer interaction and service delivery. AR’s role in remote damage assessment during claims processing and VR’s capability in creating immersive training for agents signify their revolutionary impact.

Quantum Computing

Although nascent, quantum computing’s extraordinary computational capabilities harbor the potential to redefine risk modeling, fraud detection, and portfolio optimization in insurance, offering unprecedented advances in actuarial science.

Advanced Analytics

The evolving role of big data and advanced analytics in insurance is enabling a more profound understanding of customer behaviors, risk patterns, and market trends, aiding in data-driven decision-making processes in various insurance sectors.

Autonomous Vehicles

The emergence of autonomous vehicles necessitates a reevaluation of insurance frameworks, addressing new challenges and questions related to liability and technical malfunctions.

UBI & Smart Contracts

The growing adoption of Usage-Based Insurance (UBI) and the inception of blockchain-based smart contracts are streamlining policy enforcement and claims processing, offering personalized and efficient solutions.

IoT Expansion

The widening scope of IoT has insurers exploring preventive solutions using smart home sensors and incorporating wearables for more personalized health and life insurance policies.

Final Thoughts

The insurance industry is leveraging and investing in these tech trends to maximize profits and benefit from the cost and time-saving efficiencies these technologies promise. To compete and stay relevant in the dynamic insurance landscape, insurers should explore the benefits of these transformative technological innovations.