Everyone looks forward to the day when their payment comes. After a long month of continuously grinding at work a page check is exactly what drives us to continue with the same procedure all over again. But there are multiple ways in which the payment is deposited in the bank account. In this article we will be focusing on the main differences between a paycheck and a pay stub. Let us take them up one by one.

What is a Paycheck?

A paycheck is literally a check which is given to the employees as monetary recompense for their work. It is a check return out on paper with all the relevant payment details which the employee then has to cash. The amount on a paycheck can be standard agreed on the employment contract.

It can also vary depending on the work an employee has done in a particular time frame. The defining feature of a paycheck is that it is not digital and it’s physically handed out or mailed to the employees. With more and more companies shifting to digital modes of payment, getting a paycheck has become an outdated business tradition.

About 4% of the employees still rely on getting a paper paycheck as a means of payment. It is quickly becoming a less preferred method because of the amount of time involved in due rating different paychecks for each employee. Many companies now use an automated payment platform or any other digital method of payment.

Is Any Money Deducted or Added to the Paycheck?

Deductions in the paycheck are usually on the account of taxes or any default deductions done by the company. Both of them are usually informed to the employee. Moreover, it is entirely the responsibility of the employer to let the authorities like the internal revenue service know about any withholding of payment. Usually the money added to a pay check is a bonus or some other way of appreciating the work. It can also be overtime in that particular month.

What is a Pay Stub?

A pay stub is directly related to a paycheck. It is basically a record of everything which is accounted for in the paycheck. The only difference between paycheck and paste up is that a pay stub can be both electronic and physical while a page is always a paper document.

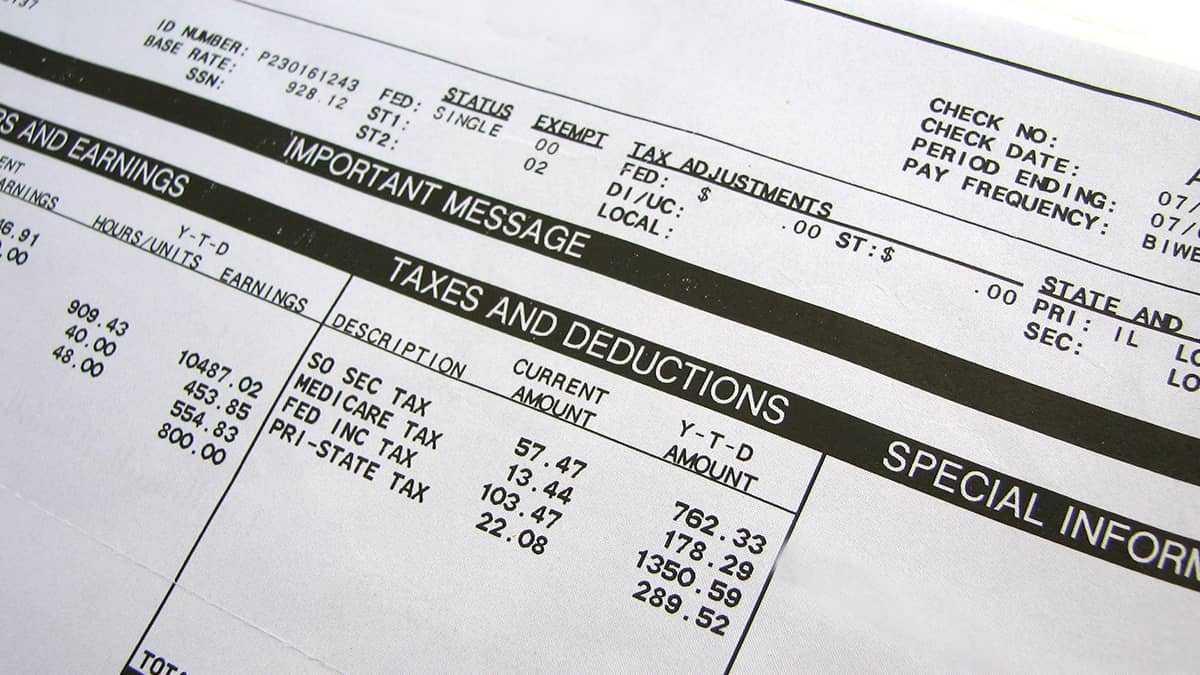

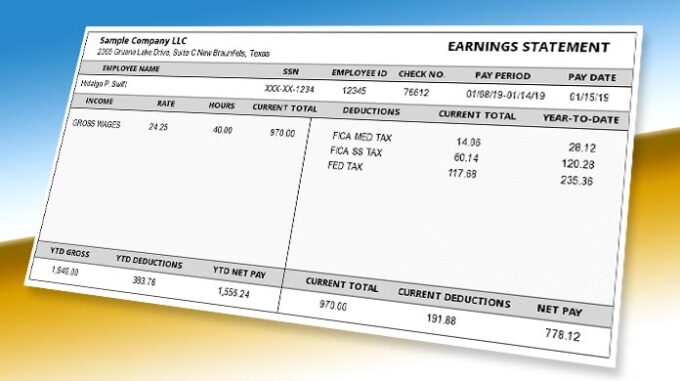

A stub includes a detailed record of all the amounts which add to the overall salary that any employee receives. Electronic records are available online and more than 80% of employees use the digital medium to access the pay stubs. The following details are mentioned on the document:

- The date of payment: The date when the check was issued by the company.

- The Addresses: The addresses of both the employee and the employer need to be on the document and both should be completely accurate.

- The period of payment: This includes the total number of days for which the payment is being issued. Usually, it is from the first of the month to the last working day.

- The rate of pay: This is the agreed upon pay rate which is also mentioned in the offer letter of the employee. Any incongruence in the period means that the calculation of the payment is inaccurate.

- Total payment: Along with the minor details, the overall amount or total pay is also mentioned. The gross pay and net pay are both mentioned on the pay stub.

In order to make sure that the payment is being done correctly, all the information needs to be upgraded periodically. The administrative facilities in the business should keep track of any changes in the name, address, and pay scale of the employee.

Even a slight change in the zip code or address can create complications. Preventable mistakes usually cause major inconvenience with taxes and climbing the payment. Finance related problems usually include delayed Bank approvals and direct deposits. You can use PaystubsCity for an easy experience.

How Should You Read a Pay Stub?

Reading a pay stub is important to understand the deductions and other details about the paycheck. Some deductions are common across all employees and one should understand what purpose they serve in order to read everything correctly.

The most common reduction is the government tax which we will be talking about later. Medicare and social security are both deductions based on the income of an employee. Some withholding is due to insurance payments, union dues, profit sharing, unemployment insurance, and local income taxes.

Know About FICA

FICA stands for Federal Insurance Contributions Act. It is a federal tax which is always deducted from any project issued by any business. The wages of each US citizen are tracked through the social security number.

The Social Security Administration keeps track of the wages one receives at the end of the month whether they are self-employed or working a job. This payroll tax cannot be avoided and is common across all businesses. One needs to be aware of FICA. It will be deducted from each of the paychecks one receives from the beginning of their work till the last payment.

The deduction of the social security tax adds to the credits on the social security number. These deductions eventually serve as benefits at the time of retirement. FICA therefore contributes to social security benefits an individual can opt for based on their lifelong credits.

The Takeaway

We can now understand the difference between a paycheck and pay stub easily. The former is a mode of payment and the other is a document including all details of payment. A paycheck is slowly going out of circulation because of that time it takes to formulate proper documentation. On the other hand, the same will not happen to a pay stub because it is the details of payment, and its deductions and additions. And since it can be accessed physically or digitally which improves its range of application.