Artificial intelligence has become a transformative force in the financial sector. While it offers numerous benefits, it also brings significant risks and challenges.

Also, we have to mention that there is a simple method you can use to detect the content made with artificial intelligence. All you need to do is to scan it with an AI checker.

This article delves into the darker aspects of finance, exploring the potential pitfalls and how they can impact the industry.

Over-Reliance on Algorithms

AI-driven algorithms can process vast amounts of data and make decisions faster than any human. However, this speed and efficiency come with a downside. Financial institutions may become over-reliant on these algorithms, leading to a lack of human oversight. When algorithms make decisions without human intervention, there is a risk of errors going unnoticed until it’s too late.

Lack of Transparency

One of the primary concerns in finance is the lack of transparency. AI systems, particularly those using deep learning techniques, can be highly complex and opaque. This opacity makes it difficult to understand how decisions are made, raising concerns about accountability. If a financial decision leads to significant losses or other negative outcomes, determining the cause can be challenging.

Cybersecurity Threats

Advanced systems in finance are attractive targets for cybercriminals. As financial institutions increasingly rely on AI, the risk of cyberattacks grows. These attacks can range from data breaches to manipulation of algorithms. For instance, if a system used for trading is compromised, it could lead to substantial financial losses.

Ethical Concerns

AI in finance raises several ethical issues. One major concern is the potential for it to perpetuate or even exacerbate existing biases. For example, if an AI system is trained on biased data, it can make biased decisions, such as unfairly denying loans to certain groups of people. Additionally, the use of surveillance and monitoring in the financial sector can lead to privacy violations.

Market Manipulation

AI-driven trading systems can potentially manipulate financial markets. High-frequency trading algorithms, for instance, can execute thousands of trades in a fraction of a second. While these systems are designed to capitalize on small price movements, they can also create market volatility. In some cases, AI algorithms have been found to engage in manipulative practices, such as spoofing, where false orders are placed to move the market in the desired direction.

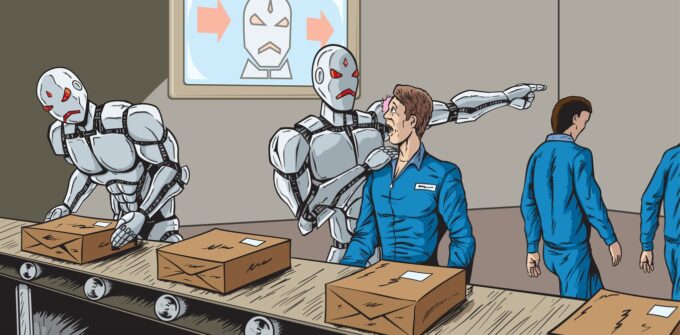

Job Displacement

The rise of AI in finance also poses a threat to jobs. As these systems become more capable of performing tasks traditionally done by humans, there is a risk of job displacement. Roles such as financial analysts, traders, and customer service representatives could be significantly impacted. While AI can create new job opportunities, the transition may be challenging for those whose roles are automated.

Regulatory Challenges

The rapid adoption of AI in finance has outpaced the development of regulatory frameworks. Regulators are struggling to keep up with the innovations and complexities introduced by AI. This lag creates a regulatory gap, where AI systems operate in a relatively unregulated environment. This lack of oversight can lead to systemic risks, as financial institutions may take on excessive risk without adequate safeguards.

Dependence on Data Quality

AI systems are only as good as the data they are trained on. In finance, poor-quality or incomplete data can lead to inaccurate predictions and decisions. Ensuring the integrity and quality of data is crucial, but it is also a significant challenge. Financial institutions must invest in robust data management practices to mitigate this risk.

Operational Risks

Implementing these systems in finance involves substantial operational risks. These systems require significant resources for development, integration, and maintenance. Additionally, there is a risk of technical failures, which can disrupt financial operations. Financial institutions must have contingency plans in place to address potential AI system failures.

Impact on Financial Stability

The widespread use in finance can impact overall financial stability. AI systems can amplify market trends, leading to increased volatility. In the event of a market downturn, AI-driven trading systems may exacerbate the situation by making rapid sell-off decisions. This procyclicality can create a feedback loop, worsening financial crises.

Legal Implications

The use of AI in finance also raises several legal questions. For instance, if an AI system makes a decision that leads to financial losses, who is held accountable? The lack of clarity around liability and accountability can create legal challenges for financial institutions. It is crucial to establish clear legal frameworks to address these issues.

Trust and Reputation

Finally, the use in finance can impact trust and reputation. Financial institutions must maintain the trust of their clients and stakeholders. If a system fails or makes a controversial decision, it can damage the institution’s reputation. Building and maintaining trust requires transparency, accountability, and ethical use.

Practical Steps for Managing Risks

To effectively manage the risks associated with AI in finance, institutions should adopt a multifaceted approach. Here are some practical steps:

- Enhance Human Oversight: Ensure that AI systems are monitored by skilled human operators who can intervene when necessary. This oversight can help catch and correct errors early.

- Promote Transparency: Develop AI systems with transparency in mind. Use explainable AI techniques to make decision-making processes more understandable.

- Strengthen Cybersecurity: Invest in robust cybersecurity measures to protect AI systems from cyber threats. Regularly update and test security protocols.

- Address Ethical Issues: Implement measures to identify and mitigate biases in AI systems. Establish ethical guidelines and frameworks to govern AI use.

- Regulate Use: Work with regulators to develop and implement comprehensive regulations for AI in finance. Ensure that AI systems comply with existing laws and standards.

- Maintain Data Quality: Invest in high-quality data management practices. Regularly audit and clean data to ensure accuracy and reliability.

- Plan for Operational Failures: Develop contingency plans to address potential AI system failures. Conduct regular drills and simulations to prepare for emergencies.

- Monitor Market Impact: Continuously monitor the impact of AI on financial markets. Implement measures to mitigate potential market manipulation and volatility.

- Clarify Legal Responsibilities: Establish clear legal frameworks to define accountability and liability for AI decisions. Ensure that all stakeholders understand their legal obligations.

- Build Trust: Focus on transparency, accountability, and ethical use of AI to build and maintain trust with clients and stakeholders. Communicate openly about AI initiatives and their potential impacts.

Conclusion

AI has the potential to revolutionize the financial sector, offering significant benefits in terms of efficiency, accuracy, and innovation. However, it also brings a host of risks and challenges that must be addressed.

Financial institutions must be vigilant in managing these risks, ensuring transparency, accountability, and ethical use of AI. By doing so, they can harness the power of AI while mitigating its dark side.