Understanding franking credits can be confusing, but it is important to understand to make the most of your nest egg.

This is especially true if you want to save yourself from getting double-taxed by the Australian Tax Office. Many Australian shareholders look into this concept when they start receiving dividends as a way to minimise their cash outflow and keep their net profit after tax relatively healthy.

If you’re a dividend earner of a company and a retiree, here are some fundamentals you should keep in mind when maximising your portfolio through these franked credits.

What Are Franking Credits?

Franking credits are a tax offset that is paid by companies to shareholders on behalf of the company in respect of fully franked dividends.

They’re a large part of the imputation system, which prevents the government from doublet taxing profits. This offset, in essence, can be used by shareholders to reduce their income tax liability.

For example, let’s assume a corporation managed by one shareholder earns a profit of $1,000 for an annual period. The Australian government generally takes 30% of that as the tax rate, leaving $700 as the net profit after tax for the firm.

This net profit after tax, however, isn’t the final profit in some cases. It may still be further deducted by the shareholder’s marginal tax rate from the $700, effectively doubling the number of times the shareholder has been taxed.

This is amended by the franking credit system, as this system recognizes that the dividends have already been paid and that the $300 is already stored as a form of credit at the ATO.

How Does Franking Credits Affect Retirees?

For those that are retired, this could possibly affect the amount of money that you need to pay for taxes.

In most cases, retirees are zero-tax investors. In Australia, this demographic has a 0% tax rate, which means they can refund the full 30% of tax taken from them as a shareholder.

If your marginal tax rate is higher than 0%, you may not be able to get the full offset and will only receive a partial refund.

This is why retirees and other zero-tax investors are one of the best beneficiaries of the franking credit system.

With that in mind, retirees should be willing to entrust their money with companies that have a history of high franking credits. They can consider franking credits with HALO Technologies to improve their investment opportunities.

5 Things You Should Know About Franking Credits

While the benefits of franking credits are extremely helpful, it’s understandable that the system can be confusing.

Here are five key things you should know about franking credits before utilising them in your own investment strategy.

1) The Eligibility Requirements for Franking Credits

To be eligible for a refund of excess franking credits, retirees will need to meet the following criteria:

- On or after July 1, 2000, you receive franked dividends directly or indirectly through a trust or partnership.

- After deducting any other tax offsets you are eligible for, your basic tax liability is less than your franking credits.

- You comply with the anti-avoidance regulations the ATO have put in place to make sure everyone pays their fair share of taxes.

The anti-avoidance rules you’ll need to meet include the holding period rules and related payment rules.

Moreover, if you form part of a partnership or trust, the partnership or trust must satisfy these requirements as well. If they don’t, you won’t be entitled to a refund, no matter how small your basic tax liability is.

2) Taxation Income is More Important for Retirees

Pension phase investors don’t need to pay capital gains tax, but other retirees have to when they sell an investment like a property. This means that the total amount of money a retiree earns from their investments, as well as the tax they pay, can vary from person to person.

These unique cases only add to the significance of franking credits, as each

person has a different financial background and required tax payment. It’s therefore critical for retirees to put taxation circumstances at the forefront of their investment strategy, as this is what will have the most significant tax implications.

3) The Franking Credit Formula

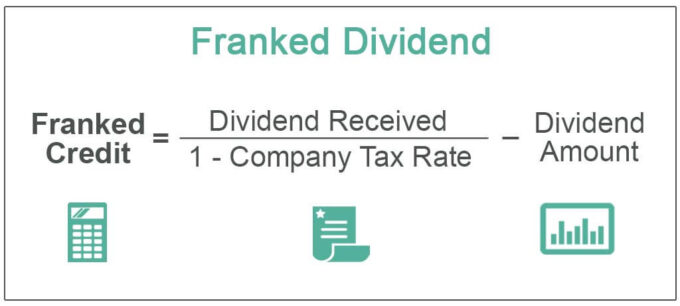

The formula for calculating franking credit is as follows:

Franking credit = (dividend amount / (1-company tax rate)) – dividend amount.

If a corporation pays a 30% tax rate and an investor receives a $70 dividend from them, their complete franking credit would be $30 for a $100 grossed-up payout.

If an investor in the same example is only eligible for a 50% franking credit, their payout for the franking credit would be $15.

4) Franking Credits Get Accrued in SMSFs

Superannuation fund members accrue franking credits through dividends. This is particularly the case for retirees who have self-managed super funds (SMSFs), where withdrawals are generally tax-free for those over 60.

This system generally benefits people of retirement age (i.g. over 60 years old) since they’re no longer obligated to pay taxes upon withdrawal.

5) Companies Aren’t Eligible for Excess Franking Credits

If individuals like retirees or trusts meet eligibility requirements for a franking credit refund, they can benefit from that.

That said, business entities are not eligible for the same tax credits. Instead, they can convert their excess franking credits to carryforward losses. These losses are shouldered into the company’s future net income to lower its tax obligation.