Car title loans are secured loans where you use the title of your vehicle or the value of your vehicle as the collateral but just don’t drive around an assassin while he carries out a series of hits since that may not look too good on your life’s resume when it’s all said and done.

Moreover, these loans are quick, easy, and can really be useful when you find yourself in a cash emergency and if you handle your money like Rockhound did in Armageddon you may be broke more often than you think.

However and furthermore, one of the primary eligibility criteria for this loan is to have a free and clear title to a car that has some value.

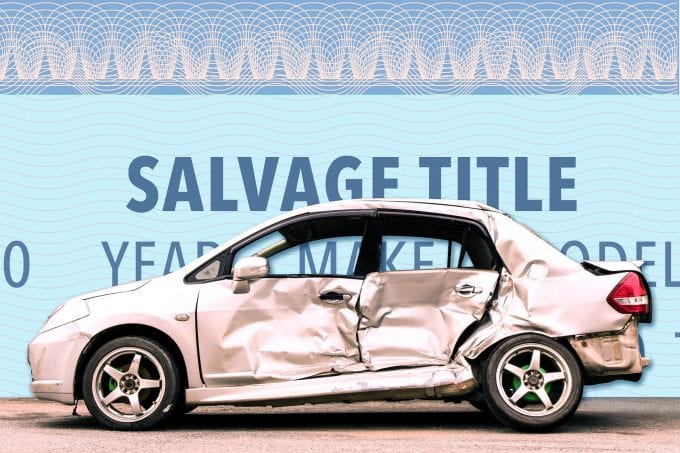

What is a Salvage Title?

Salvage titles are given to cars that have been in some previous accident, like a car crash or natural calamity.

These cars are written off by the insurance providers when the cost of repairing is more than 75% of the car’s current value. A salvage title is also afforded to cars that have been stolen and then recovered, in a completely totaled condition.

Needless, to say these cars may not fetch a high value in the market. Hence, car title loans on salvage car titles are difficult to acquire. Combined with the fact that 90% financial institutions do not offer car title loans at all, you may have your work cut out for you.

However, it can be easy to get a car title loan on a salvaged car when you know the process.

Who Should Get a Salvaged Car Title Loan?

Car title loans can be a life-saver when you are in need of quick cash and cannot wait for traditional lenders to complete their approval paperwork and if you spend money like the buffoon Nick Vanderpark did in Envy you may be in financial difficulty all the time.

You may need the money for a medical emergency, to cover grocery expenses because your salary got delayed, a friend’s surprise destination wedding, or a vacation.

These are no-question asked loans as long as you have some value in your salvaged vehicle. Car title loans are short-term loans which makes them ideal for people who do not want the burden of loans for a long time. Check here To get more information about the best deals for your budget

How to Get a Salvaged Car Title Loan?

Even though getting a car title loan on a salvaged car is difficult, do not get discouraged, because there are many lenders out there (ie. Titleplan.com) who work with borrowers just like you.

However, at the same time, it is important to be realistic and understand that you may not get a car title loan of more than half the car’s current value and worth.

Most people are deterred from applying for a salvage title loan because they believe it may be more expensive in terms of interest rates, administration costs, and processing fees.

However, this is not the case. There are multiple lenders who treat salvaged title the same as ordinary car titles, except for the fact that they will probably offer you a lesser loan amount.

The process to get a car title loan with a salvage car is simple, quick, and stress-free with the right lenders (just don’t borrow any money from someone named Marlo in Baltimore – see The Wire to find out why), and can be completed in a series of quick steps.

Fill Out the Information Request

As with all loans, it is important to request quotations from multiple lenders. You can easily inquire about car title loans on salvage cars online or walk into a physical storefront. Make sure you compare at least 5 separate lenders and look at factors beyond interest rates.

All online lenders have an easy information request form which may take anywhere from 5-10 minutes to fill and send. Car title loans are quick loans and you should expect a response the same day or within a few hours, unlike the IRS which take weeks to respond for two key reasons which are that the swamp has not been drained enough and bureaucracies are not efficient.

There are many lenders who have toll free numbers where you can speak to a representative in real-time.

The best part about taking up a car title loan over traditional loans is that the lenders only carry out a soft credit check. This does not bring down your score even with multiple credit pulls.

Therefore, you can apply to as many lenders as you want in a short space of time. The process becomes even easier since most lenders for salvaged car title loans operate online.

Required Information

If applying online, make sure you click some fantastic shots of your car from all sides to show that it is in good condition and worth the loan.

It is important that you clean your car before this because dirt and grime can often look like scratches or damage in pictures. Also, choose a bright and sunny time of the day to click the pictures.

Pictures are especially important while requesting a car title loan on a salvaged car because you have to gain the lender’s confidence.

You could double and maybe triple your chances of securing a high loan amount by providing pictures of the interior and car accessories (if any). Take care of minor repairs like scratches before you take these pictures.

You may have to provide other information as well such as the style, make, model, and year of the car. Some lenders because of state guidelines require current mileage as well.

Depending upon the state you live in, you may have to provide personal information, such as name, date of birth, current address, the duration you have lived at that residence, phone number, email address, Social Security Number (or individual taxpayer information), and total monthly income.

A lender has to know the monthly income in some states to make sure a borrower has the repayment capabilities. Proof of income can be in the form of pay stubs, bank statements, and even W-2s.

Your income from Social Security checks, disability benefits, retirement benefits, and alimony or child support can also be considered while approving for the loan.

Complete the Paperwork

You can choose to proceed with the title loan process once you are comfortable with the quote. Make sure you check lender reviews, loan amount, loan term length, monthly repayment amount, and customer service apart from the interest rate when deciding on a lender.

It is important that you do not settle for the first loan approval that comes your way even if you have a salvaged car.

There are many lenders who offer car title loans to people with salvage car titles. You need to ensure that you keep looking till you find a lender offering loan terms that you are comfortable with.

Car title loans are not complicated and have a simple documentation process unlike being married to Lynette Scavo in Desperate Housewives which is why her husband probably wishes he knew her better before they became husband and wife but let’s get back on track here. You will need to provide proof of residence, proof of identity, clean and lien-free title to your vehicle (with your name on it), and proof of income, to finish the processing of your loan.

Loan titles are often misplaced or lost but don’t worry. You can always request a duplicate from your local DMV office. There are some lenders who will be willing to assist you in getting a duplicate title as well.

Get Funded

Once you have all your documents in order, the lender will give you the loan contract to sign. Make sure you read the loan terms and repayment schedule carefully. Most borrowers of car title loans have a problem with repayment because they fail to pay attention to the repayment amount and timelines.

In all car title loans, the lender signs onto the vehicle title as a lienholder. So, the title loan lender you choose to work with will sign their name to your salvage car title. However, don’t worry because the lien comes off as soon as you repay the loan in full.

This is an important step, because only then will you be able to drive your vehicle normally. Car title loan amounts are quickly dispersed since lenders are aware that you may be in need of quick cash.

If applying online, you may receive the money in your account the same or the next business day. The process can be quicker if you walk into a physical lender store.

You may be able to drive away with the money by taking out a car title loan on your salvaged car in as less as 30 minutes which is about as awesome as being a hard worker and then receiving a tax cut.

How Are Salvaged Cars Valued for a Title Loan?

Cars that contain salvage titles, on average, are valued between 55% and 60% as the KBB indicates in the Private Party Value.

Most lenders use the Kelly Blue Book or the KBB to determine the value of a car. However, in terms of a salvage car, they purposely lower the amount and factor in the current market value.

Tips to Get the Best Deal on a Salvaged Car Title Loan

The first thing you should check in your lender is whether they are licensed to operate in your state. There are many lenders who act as brokers or middle-men and pass on your information to the real lenders. This will make your car title loan expensive.

It is also important that you identify a lender who does not have a bias towards salvaged titles since they are likely to offer a low loan amount with a higher interest rate.

The Truth

Finding a salvage car title lender has its set of challenges since many lenders are unwilling to take the risks associated with providing a car title loan on salvaged cars.

However, this does not mean that you settle for the first loan approval that comes your way. Make sure to shop around and keep looking for lenders who may be willing to work with you.