The wicked one borrows but does not payback! Ever heard that biblical say? It is so important to repay debt. Realistically, it is so easy to borrow money than it is to repay. And the fact that there is a cost associated with using borrowed money makes it even discouraging. But again, do not forget how that loan saved you when you really needed funds.

Since it requires concerted efforts to repay the loans, I like telling friends to borrow only when it is necessary. Some may argue that an emergency may force you to borrow. But why have you not saved for emergencies? Emergencies will always strike at the time least expected. However, you should always save funds to finance unexpected costs.

The reason why you need to avoid relying on loans to solve your financial problems is that your financial life may be ruined without you knowing. Let me tell you what happens to my friend Jim. He had an emergency and took a payday loan, thinking that he will manage to repay before the next payday.

Indeed, he paid as expected. However, he was destabilized and had to take another loan. That is how he got himself in the vicious cycle of payday loans. It took a lot to salvage his condition and we don’t want this to happen to you. That is why we are discussing here the 9 simple and pain-free tips on how to be out of it. It is our hope that the tips we are we are going to discuss here will salvage your condition. So, let us begin.

The Pain-Free Tips on How to Be Out of Debt

Failure to pay attention to red flags may lead you borrowing too much than what you can afford. This situation will deprive your peace of mind. I mean, how do you feel every end month when you must make several payments? And what you cannot even afford to make the payments? You begin to bother family members and friends. If you are already in debt, the following tips will free you from that chain:

1. Analyze your debts

A payment plan cannot be effective if you do not know the total value of all your dues. You also must understand the reason why you are in your current state as far as debt is concerned. This is the best starting point and will help you plan effectively. Simply, sit down and list all the dues and the interest in each one of them. Also, list all your expenses and weigh their value against your net income. This will give a deep insight into your spending (we will come to this later).

2. Draft a budget

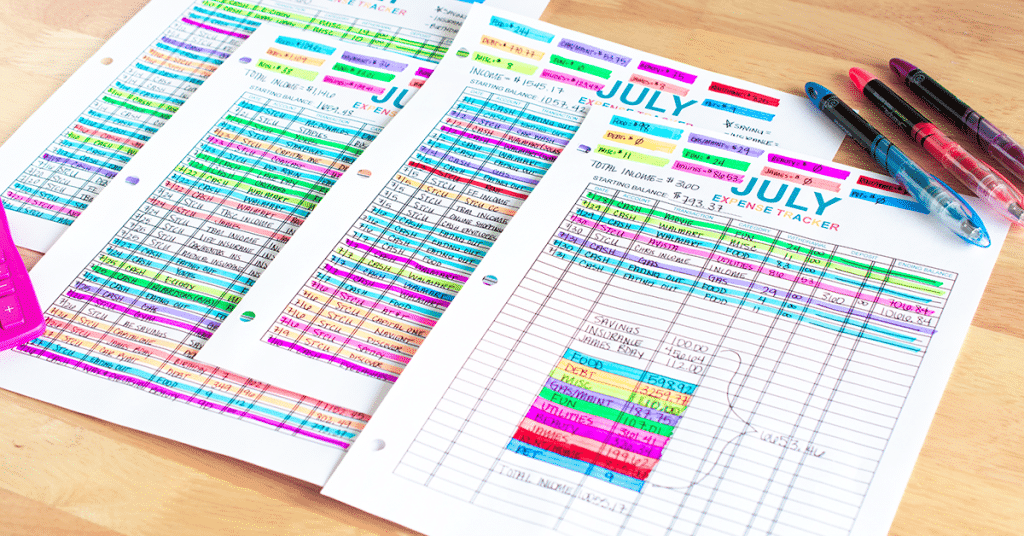

Failure to plan has often been perceived as planning to fail. If you do not believe this, then that is probably one of the main reasons why you are in the state of owing money. As we mentioned in our first bullet, you need to know where your income goes. The basic tips of getting out of it are to include tracking your expenses, lessening you’re over dues and making a saving plan.

You can only achieve all these if you have a monthly budget. That why financial experts will ask you to budget. Put simply, budgeting directs your money and gives it a purpose. With it, you can set all your spending needs such as rent and groceries and still account for wants such as clothes and entertainment. Your budget should be flexible enough to accommodate the necessary changes. How can you make a good budget? Use the strategy we discussed earlier – the 50/30/20 rule.

3. Track your expenditure

As we mentioned earlier, tracking your spending is a basic tip that can help you get out of over dues. Can you tell how much you spend monthly on living expenses? If you cannot try to know what consumes your money, you are more likely to repeat the same mistakes and get into other dues even after settling the current one.

4. Cultivate some good spending habits

You want to get out of it and that can be so difficult if maintain the same behaviors. With a change in behavior, you are going to save more money for your due payments. How? For instance, buying food is expensive. Substitute this habit with cooking your food and home. Carry lunch to work and you will save a lot of meals. Consider using public means of transport. Buy second-hand products and you will save a lot.

More importantly, when visiting the grocery shop, make sure you have a list of what you are going to buy before leaving the house. Once you are there, pick the commodities, pay and leave immediately.

You will avoid overspending on the grocery. One of the reasons why you are in this situation is poor spending habits. To develop these useful habits and you need to avoid getting into money owing to the state. Besides, you will have extra funds to pay your current outstanding balance.

5. Get more income

Do you know the only routes you can use for positive cash-flow? Spend the less you can, earn the much you can or a combination of the two. You can improve your finances by earning more income however challenging that can be. If there are overtime opportunities, consider that.

Additionally, think of other skills you may be having and can be converted into money-earning activity. You can become a plumber, write articles, or work on a part-time basis. Also, you can sell any item you do not use. The purpose of all these initiatives is to earn extra money to help settle your debt.

6. Avoid debt-enabling behaviors

Human beings have the tendency of developing behaviors. Sadly, we can always adopt bad ones. For instance, overeating is a habit, isn’t it? What about smoking? Such habits not only affect your health but also drain your finances. Avoid such behaviors and apart from avoiding getting into more dues, you will save more funds that can help pay the current ones.

7. Consolidate debt

This is a strategy that involves combining all your outstanding financial obligation and replacing them with one debt of lower interest rate and better terms. It is expensive and so demanding to make several payments every month. Consolidating your dues makes it manageable.

8. Save funds

Statistics show that more than 67% of Americans do not have savings that can cover at least 6 month-expenses. What if you are plagued with an emergency? You will turn to debts again. Saving funds will help you avoid borrowing when faced with emergencies. Maybe you feel it is impossible to save when you are already struggling to get out of debt. But it is very easy. Start even with just one dollar. It counts in the end.

9. Keep in touch with your lender’s

Maintain a good standing before your creditors through constant communication. If you anticipate you may not afford to make a payment, talk to the lender in advance. You can check out reliablemoneylender.sg and they can readjust your payment schedule and this will save you from penalties of late and missed payments. Such charges often increase the obligation and make it difficult to manage the money that we owe.

Do you want to be debt-free? Follow these nine simple tips we have discussed in this blog and you will successfully attack your debt. If you feel overwhelmed, you can still talk to a loan advisor and you will receive professional help. Try to avoid borrowing more funds as this will compound your problem.