There is a flip side to everything, including Healthcare. Whatever you can possibly imagine for healthcare system in the U.S., the opposite is always true. If you think cost pressures are squeezing the margins of healthcare companies, check out the solid income statements of Biopharma companies. If you think value-based care models & new entrants are disrupting healthcare, check out the healthy balance sheet of care providers. The staggering growth in health insurance revenues also confirms this paradox. Of course, there lies a rainbow of shades between the spectrum of growth and challenges. This report is prepared to better understand these different shades – growth industries, challenged segments, top 20 U.S. Healthcare companies by 2016 revenues, and the industry laggards.

This report is created using R&P U.S. Top 3000 database. All the public healthcare companies with revenues more than $50 million in 2016 are included in this analysis. While data alone can not predict the future of the segment. However, it does provide a strong base to understand the commercial environment that the individual companies face.

Please read through the report to understand the industry dynamics and reach out to us for any queries or suggestions.

U.S. Healthcare Market

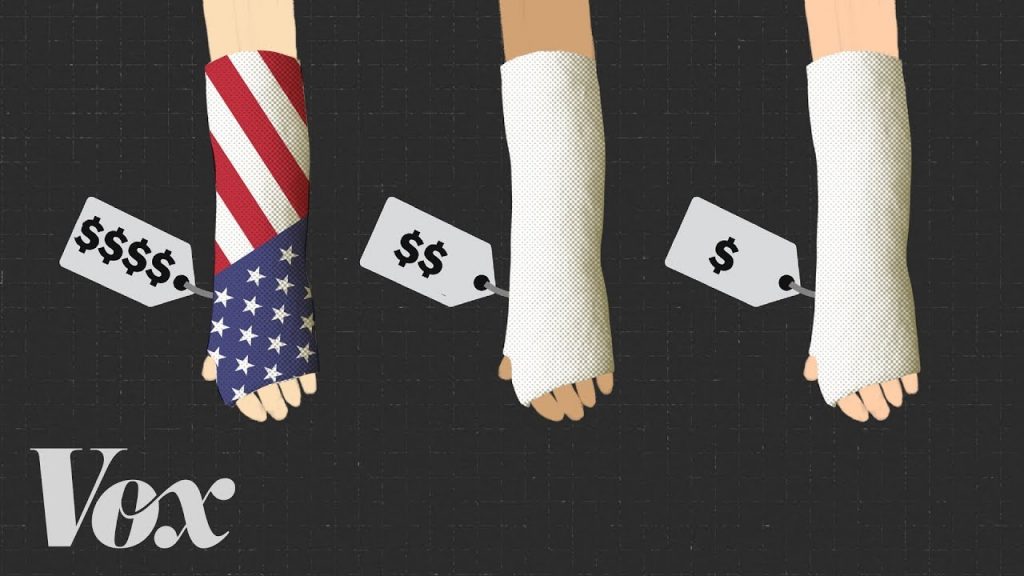

Healthcare constitutes one of the most important segments of the U.S. economy. According to recent government projections, healthcare is expected to account for more than $1 out of every $5 spent in US by 2025. For example, on average, the couple may pay $20,000-25,000 for the IVF treatment to conceive on the basis of this article. As per these estimates, U.S. spending on healthcare is expected to be $5.6 Trillion by 2025.

Healthcare companies in all segments are also heavily influenced by health reforms, cost pressures, value-based care models, disruptive innovations by technology players, and by political instability. Still, the sector has managed to maintain a growth trajectory and has continued to grow over the years.

What do these staggering numbers reveal? Are all industry segments driving this insane growth? To identify these outliers, let us first understand the healthcare ecosystem and the key constituents of this sector.

U.S. Healthcare Ecosystem And Major Market Segments

Healthcare reforms throughout the world have brought about a much more complex and fragmented structure of healthcare market. The increasingly fragmented structure of healthcare systems has prompted the creation of multiple points of interaction between insurers, providers, and suppliers. The chart below depicts the most crucial players and the ways each one interacts with others in the system.

There were 290 healthcare companies with revenues above $50 Million in the year 2016. These companies can be broadly classified into following two categories:

- Life Sciences Companies: Includes Pharmaceuticals, Biotechnology, Medical Devices, and Diagnostics & Scientific instrument manufacturers.

- Healthcare Service Providers: Includes Medication Stores, PBM and Distributors, Payers, Providers, Medical Software, and Healthcare Research Services providers.

Following chart shows the distribution of healthcare companies by industries.

Healthcare sector is not evenly distributed across nine industry segments. Medical Devices is the largest industry segment with 81 companies. There are 49 Pharmaceutical companies, 45 Biotechnology companies, 35 Healthcare Providers, 22 Diagnostics & Scientific Instruments manufacturers, 16 Medical Software companies, 14 Healthcare Payers, 14 Healthcare Research Services companies, and 14 PBM, Medications & medical devices Wholesalers and Medication stores.

Let us analyze the industries that are driving the growth of healthcare sector.

U.S. Healthcare Industry Revenues and Profits Analysis

U.S. Healthcare market grew by 11% to $2.2 Trillion in the year 2016. PBM, Medication Stores and Distributors was the largest industry segment with $924 Billions of revenues. Payers segment generated $510 Billions of revenues. 49 pharmaceutical companies generated $300 Billions of revenues in the year 2016.

Following chart shows the revenues of healthcare companies by industries.

Revenue Share By Industries

Just 14 PBM, Medication stores and Distributors contributed to 41% of the total Healthcare revenues. 14 payers contributed to 23% of the total Healthcare revenues. 49 Pharmaceuticals companies contributed to 13% of the total healthcare revenues in the year 2016.

Following chart shows the revenue contribution of healthcare companies by industries.

Net Income Share By Industries

Healthcare industry profits are skewed towards Pharmaceutical and Biotechnology companies. 57% of the total Healthcare net income was generated by pharmaceutical & Biotechnology companies.

Following chart shows the Net Income contribution of healthcare companies by industries.

Top 20 U.S. Healthcare Companies By 2016 Revenues

2016 list of top 20 U.S. Healthcare companies is dominated by Medication stores, PBM and Distributors, and payers.

Following chart shows the ranking and revenues of top 20 Healthcare companies in year 2016.

Breakdown of top 20 U.S. healthcare companies by 2016 revenues

- Six companies from Medication stores, PBM and Distributors segment

- Six companies from Payers segment

- Three Pharmaceutical companies

- Two Biotechnology companies

- Two Medical Devices companies

- One healthcare provider

Our analysis also confirms that Healthcare sector is very top heavy. 73% of all the Healthcare revenues in the year 2016 were generated by the following top 20 Healthcare companies.

Top 20 U.S. Healthcare Companies By 2016 Revenues

1. McKesson Corporation Revenues & Profits – 2016

Industry Segment: MedicationStores, PBM and Distributors

Headquarters: California

URL: www.mckesson.com

2016 revenues: $190.9 billion

2015 revenues: $179.0 billion

Y-O-Y revenue growth: 6.1%

2016 net income: $2.3 billion

2016 net margins: 6.1%

McKesson corporation ranked no.1 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a pharmaceutical distribution services and information technology company. The Company operates through two segments: McKesson Distribution Solutions and McKesson Technology Solutions. Mckesson’s revenues in 2016 grew by 6.1% to $191 billion. Mckesson’s net income was $2.3 billion in the year 2016.

2. UnitedHealth Group Inc. Revenues & Profits – 2016

Industry Segment: Payers

Headquarters: Minnesota

URL: www.unitedhealthgroup.com

2016 revenues: $184.9 billion

2015 revenues: $157.1 billion

Y-O-Y revenue growth: 17.7%

2016 net income: $7.0 billion

2016 net margins: 3.8%

UnitedHealth Group Incorporated ranked no.2 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a health and well-being company. The Company operates through four segments: UnitedHealthcare, OptumHealth, OptumInsight and OptumRx. UnitedHealth Group’s revenues in 2016 grew by 17.7% to $185 billion. UnitedHealth Group’s net income was $7.0 billion in the year 2016.

3. CVS Health Corporation Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Rhode Island

URL: www.cvshealth.com

2016 revenues: $177.5 billion

2015 revenues: $153.3 billion

Y-O-Y revenue growth: 15.8%

2016 net income: $5.3 billion

2016 net margins: 3.0%

CVS Health Corporation, ranked no.3 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is an integrated pharmacy healthcare company. It operates through three segments: Pharmacy Services, Retail/LTC and Corporate. CVS Health’s revenues in 2016 grew by 15.8% to $153 billion. UnitedHealth Group’s net income was $5.3 billion in the year 2016.

4. Amerisourcebergen Corporation Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Pennsylvania

URL: www.amerisourcebergen.com

2016 revenues: $146.9 billion

2015 revenues: $135.9 billion

Y-O-Y revenue growth: 8.0%

2016 net income: $1.4 billion

2016 net margins: 1.0%

AmerisourceBergen Corporation, ranked no.4 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a pharmaceutical sourcing and distribution services company. The Company’s segments include Pharmaceutical Distribution and Other. The Company provides services to healthcare providers, and pharmaceutical and biotech manufacturers. AmerisourceBergen’s revenues in 2016 grew by 8.0% to $147 billion. Amerisourcebergen’s net income was $1.4 billion in the year 2016.

5. Cardinal Health Inc. Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Ohio

URL: www.cardinal.com

2016 revenues: $121.5 billion

2015 revenues: $102.5 billion

Y-O-Y revenue growth: 18.5%

2016 net income: $1.4 billion

2016 net margins: 1.2%

Cardinal Health, Inc., ranked no.5 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a healthcare services and products company. The Company operates through two segments: Pharmaceutical and Medical. The Company provides solutions for hospital systems, pharmacies, ambulatory surgery centers, clinical laboratories and physician offices across the world. Cardinal Health’s revenues in 2016 grew by 18.5% to $122 billion. Cardinal Health’s net income was $1.4 billion in the year 2016.

6. Walgreens Boots Alliance Inc. Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Illinois

URL: www.walgreensbootsalliance.com

2016 revenues: $117.4 billion

2015 revenues: $103.4 billion

Y-O-Y revenue growth: 13.4%

2016 net income: $4.2 billion

2016 net margins: 3.6%

Walgreens Boots Alliance, Inc., ranked no.6 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a holding company. The Company is a pharmacy-led health and wellbeing company. The Company operates through three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. Walgreens Boots Alliance’s revenues in 2016 grew by 13.4% to $117 billion. Cardinal Health’s net income was $4.2 billion in the year 2016.

7. Express Scripts Holding Company Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Missouri

URL: www.express-scripts.com

2016 revenues: $100.3 billion

2015 revenues: $101.8 billion

Y-O-Y revenue growth: -1.4%

2016 net income: $3.4 billion

2016 net margins: 3.4%

Express Scripts Holding Company, ranked no.7 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a pharmacy benefit management (PBM) company. The Company is engaged in providing healthcare management and administration services to its clients, including managed care organizations, health insurers, third-party administrators, employers, union-sponsored benefit plans, workers’ compensation plans and government health programs. The Company operates through two segments: PBM and Other Business Operations. Express Scripts’s revenues in 2016 declined by -1.4% to $100 billion. Cardinal Health’s net income was $3.4 billion in the year 2016.

8. Anthem Inc. Revenues & Profits – 2016

Industry Segment: Medication Stores, PBM and Distributors

Headquarters: Indiana

URL: www.antheminc.com

2016 revenues: $84.9 billion

2015 revenues: $79.2 billion

Y-O-Y revenue growth: 7.2%

2016 net income: $2.5 billion

2016 net margins: 2.9%

Anthem, Inc., ranked no.8 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a health benefits company. The Company operates through three segments: Commercial and Specialty Business, Government Business and Other. Anthem’s revenues in 2016 grew by 7.2% to $85 billion. Anthem’s net income was $2.5 billion in the year 2016.

9. Johnson & Johnson Revenues & Profits – 2016

Industry Segment: Pharmaceuticals

Headquarters: New Jersey

URL: www.jnj.com

2016 revenues: $71.9 billion

2015 revenues: $70.1 billion

Y-O-Y revenue growth: 2.6%

2016 net income: $16.5 billion

2016 net margins: 23.0%

Johnson & Johnson, ranked no.9 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a holding company. The Company and its subsidiaries are engaged in the research and development, manufacture and sale of a range of products in the healthcare field. The Company operates through three segments: Consumer, Pharmaceutical and Medical Devices. Johnson & Johnson’s revenues in 2016 grew by 2.6% to $72 billion. Johnson & Johnson’s net income was $16.5 billion in the year 2016.

10. Aetna Inc. Revenues & Profits – 2016

Industry Segment: Payers

Headquarters: Connecticut

URL: www.aetna.com

2016 revenues: $63.2 billion

2015 revenues: $60.3 billion

Y-O-Y revenue growth: 4.7%

2016 net income: $2.3 billion

2016 net margins: 3.6%

Aetna Inc., ranked no.10 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a diversified healthcare benefits company. The Company operates through three segments: Health Care, Group Insurance and Large Case Pensions. Aetna Inc’s revenues in 2016 grew by 4.7% to $63 billion. Aetna Inc’s net income was $2.3 billion in the year 2016.

11. Humana Inc. Revenues & Profits – 2016

Industry Segment: Payers

Headquarters: Kentucky

URL: www.humana.com

2016 revenues: $54.3 billion

2015 revenues: $54.4 billion

Y-O-Y revenue growth: 0.2%

2016 net income: $614 million

2016 net margins: 1.1%

Humana Inc., ranked no.11 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a health and well-being company. The Company’s segments include Retail, Group, Healthcare Services and Other Businesses. Humana Inc’s revenues in 2016 grew by 0.2% to $54.3 billion. Humana Inc’s net income was $614 million in the year 2016.

12. Pfizer Inc. Revenues & Profits – 2016

Industry Segment: Pharmaceuticals

Headquarters: New York

URL: www.pfizer.com

2016 revenues: $52.8 billion

2015 revenues: $48.9 billion

Y-O-Y revenue growth: 8.1%

2016 net income: $7.2 billion

2016 net margins: 13.7%

Pfizer Inc., ranked no.12 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health and Pfizer Essential Health. Pfizer Inc’s revenues in 2016 grew by 8.1% to $53 billion. Pfizer Inc’s net income was $7.2 billion in the year 2016.

13. HCA Holdings Inc. Revenues & Profits – 2016

Industry Segment: Providers

Headquarters: Tennessee

URL: www.hcahealthcare.com

2016 revenues: $41.5 billion

2015 revenues: $39.7 billion

Y-O-Y revenue growth: 4.6%

2016 net income: $2.9 billion

2016 net margins: 7.0%

HCA Holdings, Inc., ranked no.13 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a holding company. The Company, through its subsidiaries, owns and operates hospitals and related healthcare entities. The Company owns, manages or operates hospitals, freestanding surgery centers, freestanding emergency care facilities, urgent care facilities, walk-in clinics, diagnostic and imaging centers, radiation and oncology therapy centers, rehabilitation and physical therapy centers, physician practices and various other facilities. HCA Holdings’s revenues in 2016 grew by 4.6% to $42 billion. HCA Holdings’s net income was $2.9 billion in the year 2016.

14. Centene Corporation Revenues & Profits – 2016

Industry Segment: Payers

Headquarters: Missouri

URL: www.centene.com

2016 revenues: $40.6 billion

2015 revenues: $22.8 billion

Y-O-Y revenue growth: 78.4%

2016 net income: $562 million

2016 net margins: 1.4%

Centene Corporation, ranked no.14 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a healthcare company. The Company provides a portfolio of services to government sponsored healthcare programs, focusing on under-insured and uninsured individuals. The Company operates through two segments: Managed Care and Specialty Services. Centene Corporation’s revenues in 2016 grew by 78.4% to $41 billion. Centene Corporation’s net income was $562 million in the year 2016.

15. Merck & Co. Inc. Revenues & Profits – 2016

Industry Segment: Pharmaceuticals

Headquarters: New Jersey

URL: www.merck.com

2016 revenues: $39.8 billion

2015 revenues: $39.5 billion

Y-O-Y revenue growth: 0.8%

2016 net income: $3.9 billion

2016 net margins: 9.8%

Merck & Co., Inc., ranked no.15 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a global healthcare company. The Company offers health solutions through its prescription medicines, vaccines, biologic therapies and animal health products. It operates through four segments: Pharmaceutical, Animal Health, Healthcare Services and Alliances. Merck & Co’s revenues in 2016 grew by 0.8% to $39.8 billion. Merck & Co’s net income was $3.9 billion in the year 2016.

16. Cigna Corp. Revenues & Profits – 2016

Industry Segment: Payers

Headquarters: Connecticut

URL: www.cigna.com

2016 revenues: $39.7 billion

2015 revenues: $37.9 billion

Y-O-Y revenue growth: 4.7%

2016 net income: $1.9 billion

2016 net margins: 4.7%

Cigna Corporation, ranked no.16 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a health services company. The Company offers medical, dental, disability, life and accident insurance and related products and services. The Company’s segments include Global Health Care, Global Supplemental Benefits, Group Disability and Life, and Other Operations and Corporate. Cigna Corp’s revenues in 2016 grew by 4.7% to $39.7 billion. Cigna Corp’s net income was $1.9 billion in the year 2016.

17. Rite Aid Corp. Revenues & Profits – 2016

Industry Segment: Medication Stores

Headquarters: Pennsylvania

URL: www.riteaid.com

2016 revenues: $30.7 billion

2015 revenues: $26.5 billion

Y-O-Y revenue growth: 15.9%

2016 net income: $165 million

2016 net margins: 0.5%

Rite Aid Corporation, ranked no.17 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a retail medication store chain. The Company’s segments include Retail Pharmacy and Pharmacy Services. The Company operates under The Rite Aid name. It operates approximately 4,560 stores in over 30 states across the country and in the District of Columbia. Its subsidiaries include Envision Insurance Company (EIC), RediClinic and Health Dialog. Rite Aid Corp’s revenues in 2016 grew by 15.9% to $30.7 billion. Rite Aid Corp’s net income was $165 million in the year 2016.

18. Gilead Sciences Inc. Revenues & Profits – 2016

Industry Segment: Biotechnology

Headquarters: California

URL: www.gilead.com

2016 revenues: $30.4 billion

2015 revenues: $32.6 billion

Y-O-Y revenue growth: -6.9%

2016 net income: $13.5 billion

2016 net margins: 44.4%

Gilead Sciences, Inc., ranked no.18 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational medications includes treatments for Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS), liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions. Gilead Sciences, Inc’s revenues in 2016 declined by 6.9% to $30.4 billion. Gilead Sciences, Inc’s net income was $13.5 billion in the year 2016.

19. Medtronic PLC Revenues & Profits – 2016

Industry Segment: Medical Devices

Headquarters: Dublin

URL: www.medtronic.com

2016 revenues: $28.8 billion

2015 revenues: $20.3 billion

Y-O-Y revenue growth: 42.3%

2016 net income: $3.5 billion

2016 net margins: 12.3%

Medtronic Public Limited Company, ranked no.19 in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a medical technology, services and solutions company. The Company operates in four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group and Diabetes Group. Medtronic PLC’s revenues in 2016 grew by 42.3% to $28.8 billion. Medtronic PLC’s net income was $3.5 billion in the year 2016.

20. Abbvie Inc. Revenues & Profits – 2016

Industry Segment: Biotechnology

Headquarters: Illinois

URL: www.Abbvie.com

2016 revenues: $25.6 billion

2015 revenues: $22.9 billion

Y-O-Y revenue growth: 12.2%

2016 net income: $5.9 billion

2016 net margins: 23.2%

AbbVie Inc., ranked no.2o in “Top 20 U.S. Healthcare Companies By 2016 Revenues” list, is a research-based biopharmaceutical company. The Company is engaged in the discovery, development, manufacture and sale of a range of pharmaceutical products. It offers products in various categories, including HUMIRA (adalimumab), Oncology products, Virology Products, Additional Virology products, Metabolics/Hormones products, Endocrinology products and other products. AbbVie Inc’s revenues in 2016 grew by 12.2% to $25.6 billion. AbbVie Inc’s net income was $5.9 billion in the year 2016.

This report is built using R&P U.S. Top 3000 database. Please reach out to us for any queries or suggestions.