Money is tight for millions of people around the world–not just here in the U.S. It’s no secret that the world economy is unstable and uncertain. The COVID-19 pandemic has impacted so many people emotionally, physically, and financially.

People have lost their jobs and have applied for unemployment benefits. With large sums of people out of work, working less, or stuck at home, it is no wonder that people have resorted to credit cards and fast loans to get through this and do their best to survive through the financial turmoil.

The financial results of the pandemic are yet to be determined, but it is clear that a credit bubble has resulted. Between the high use of credit and unemployment benefits, a lot of people are using other people’s money to get by. Credit, however, is unsustainable if you can’t pay the money back as soon as possible to keep your interest low.

Whatever your financial situation, you should do your best to get out of your debt as soon as possible. Not only will it provide peace of mind and a newfound stability, you will be saved from the coming economic burst that will inevitably come as the pandemic becomes just a memory. One thing is for sure, the economic results of the pandemic are not yet clear. Here are a few ways to get out of your credit dependence.

Stop Spending with Credit

The first thing you should do is stop spending on your credit card immediately. You won’t be able to pay the money back if you keep using credit for purchases and monthly payments. It’s logical. If you spend more on credit, it will feel nearly impossible to get out of the debt hole.

An alternative is a service like LeapCredit.com, which will offer short-term loans. Once you stop using credit, you’ll have a better handle on your financial situation because it will be more accurate to what you have. It will become clear what you need to pay back every month to successfully eliminate your debt.

Don’t Make the Minimum Payments

Minimum payments are designed to make money off you. The interest will increase and it will take you a while to pay back the money you owe to lenders. When it comes to credit and other forms of debt, it is always advisable to pay back what you owe as soon as you can.

Don’t harm your other finances, but pay it back when you can afford it. It is absolutely imperative to make as large a payment as possible. You’ll be a lot better off for it because you will be getting out of debt faster. It might not feel great to keep paying off the debt instead of saving, but repaying what you owe is the most important thing to stay financially healthy.

Consolidate Debts

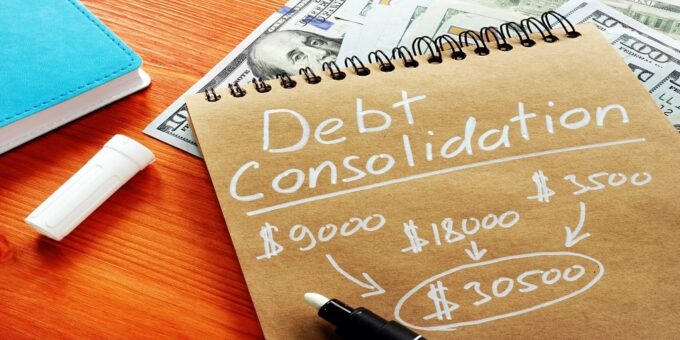

If you are struggling with multiple debts to different credit companies and other lenders, you should consolidate what you owe in a single payment with one interest rate. When you take the time to consolidate, you’ll lower what you owe and get a better handle on the debt, have a lower interest rate, and one monthly payment.

It will give you clarity to understand what you should pay before you consolidate and what will benefit you from putting the payments together a single balance you owe to only one creditor. Once you have a clear view of the debt you have, it’ll be a lot easier for you to understand and pay the money back. While you can consolidate debt by yourself, another way to do it is to work with professional debt consultants.

Work with Debt Professionals

Are you feeling overwhelmed by debt? It can be stressful and anxiety-ridden. If you don’t know where to start and what to pay off first, you should consult some financial professionals to find the best way to pay off what you owe immediately. There are experts in debt consolidation.

Not only will you be able to work with people who understand the ins and outs of debt by your side, you will be able to create a sense of peace of mind. They will help you determine what to pay off first and why. Each debt will have a different interest rate. You should do your best to pay back the debts with the highest interest because it will start to pile up.

Avoid Debt in the Future

When you have a credit card or other forms of debt, it is necessary to pay it back as soon as possible. The interest will continue to go up the longer you wait. If you use credit it should be for an emergency. Once you have paid back what you owe, avoiding debt in the future is imperative.

Stop using your credit to pay for daily expenses. Don’t let it become overwhelming, rarely use credit and you will be able to stay on top of the payments. If you do take out a loan or use credit to finance something, it is absolutely pivotal to pay the money back right away.

Are you currently struggling with debt? While it is completely normal to be going through hard financial times during the pandemic, it is more important to get out of your debt situation than ever. With so many people using credit to get through this, there is a bubble blowing up. It won’t last forever.

We don’t know the financial repercussions of the pandemic yet, but one thing is for sure. You should do your best to get out of your debt hole by paying back what you owe and getting on top of your finances as soon as possible. It won’t be easy, but getting started is the most important thing. You will be happy when the economy takes a turn and you have already paid back your debt. It will lower your stress and anxiety. You’ll be a lot better off than avoiding it forever. You should get started today!