Online trading has been around for many years, and yet it is an unknown subject to many people. There are many different ways to begin this activity however, still people are afraid of taking the initiative for different reasons.

But what do we mean when we start speaking about online trading? While most people would like a direct answer, that may not be so easy and straightforward as wished. That’s mainly because when we speak about online trading, we are referring to the act of trading of many different financial instruments, often very different between them (imagine the difference between stocks and cryptos), through the usage of trading platforms enhanced by a broker.

With that kept in mind we’ll try to explain what is online trading and how to begin it, and we do that also thanks to the essential information acquired by tradingonline.com.

What Is It?

Willing or not, everybody is familiar with the very concept of trading, especially if we think of stock trading and all the cult movies which made it famous worldwide such as “Wall Street” or Leonardo di Caprio in “The Wolf of Wall Street”. We buy an asset, such as stocks for example, at a certain price and then sell them when their price goes up.

In our case, those assets are not bought or sold in a stock exchange, instead they are traded in the so-called OTC (Over-the-counter) Markets. These markets are not regulated and trades do not happen “live”, such as in the Major Stock Exchange worldwide, like the Milan Exchange or NYSE, instead trades only happen through the net.

It goes without saying that such a system is perfect for online trading and due to the fact that most assets are traded via a derivative called CFD (Contracts for Differences), they are also relatively cheap if compared to standard financial trading investments.

In order to do so though, you will need an online broker which will allow you to open a trading account and use it to access a trading platform.

Starting With The Right Broker

One of the most essential aspects when starting online trading is starting with the right broker.

No matter what market or specific asset you’re interested in, you must think first to your future broker and all the perks and tools that have to offer to you. But even more important: you must remember that a broker must be regulated to be considered trustworthy. For additional information, you can check https://5bestproprietarytradingfirms.com/.

A regulated broker is easy to find because it follows a regulation imposed by one or more regulatory bodies. Those regulators release a license to prove that a brokerage service is legitimate to offer their service in a jurisdiction, therefore safe to invest money with it.

In other cases, if you follow the path of non-regulated brokers, you’ll not have any kind of guarantee that your future broker may scam you, disappear with all their traders’ money or apply outrageous fees.

Among some of the most important regulators worldwide we remember:

- ASIC – Australian Securities and Investments Commission (Australia)

- BACEN – Banco Central do Brasil (Brazil)

- BVI – British Virgin Islands Financial Services Commission (British Virgin Islands)

- CBR – Central Bank of Russia (Russia)

- CSRC – China Securities Regulatory Commission (China)

- CYSEC – Cyprus Securities and Exchange Commission (Cyprus)

- ESMA – European Securities and Markets Authority (European Union)

- FCA – Financial Conduct Authority (United Kingdom)

- FinCEN – Financial Crimes Enforcement Network (USA)

- FINMA – Swiss Financial Market Supervisory Authority (Switzerland)

- FMA – Financial Market Authority (Liechtenstein)

- FSA – Financial Service Authority (St. Vincent & The Grenadines)

- FSC – Financial Services Commission (South Korea)

- HKMA – Hong Kong Monetary Authority (Hong Kong)

- IIROC – Investment Industry Regulatory Organization of Canada (Canada)

- JFSA – Financial Services Agency (Japan)

- MAS – Monetary Authority of Singapore (Singapore)

- SEBI – Securities and Exchange Board of India (India)

- SEC – Securities & Exchange Commission (USA)

- SFC – Hong Kong Securities and Futures Commission (Hong Kong)

- SFSA – Seychelles Financial Services Authority (Seychelles)

Beside the regulation, it is also important to check other vital aspects of a proper online broker, such as the trading platforms accessible within their service (remember that they can be more than just one offered by an only broker), low minimum deposits and low spreads for those interested in certain trading strategies.

So, how to choose between so many names we find on the net?

Our Two Picks

To help you out with your decision as a beginner trader, we decided to give you our list of the best regulated brokers for beginners today.

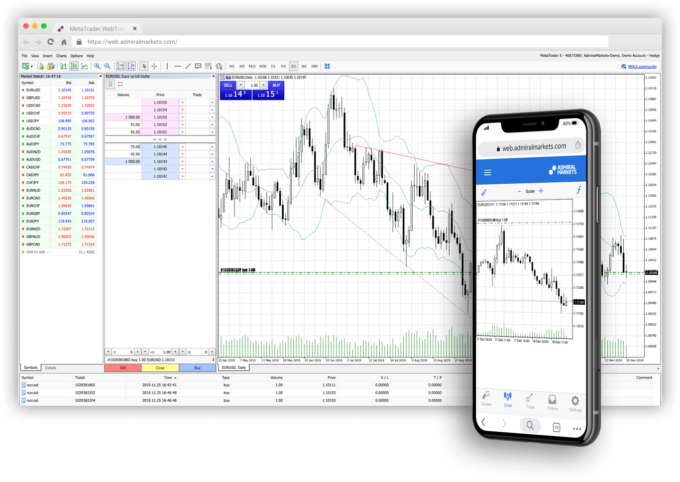

1. Admiral Markets

A brokerage service originally founded in Russia, it now gain international renown and became extremely important for new and old traders thanks to their push towards automated trading and MetaTrader4 and MetaTrader5 platforms.

Thanks to this broker you’ll be able to trade assets such as:

- Forex Pairs

- Index

- Stocks

- Commodities

- Cryptos

- Bonds

They also have well-rounded regulations that make them a good fit for many traders across the world, and with a very low minimum deposit required to open an account of only 100 dollars, which is way below the average compared to the competition.

BASIC INFO

- Regulated by: FCA, MIFID-ESMA, ASIC, CYSEC

- Trading Platforms Available: MT4 Desktop, MT4 Web, MT5 Desktop, MAC Platforms

- Leverage: yes

- Minimum Deposit Required: $100

- Minimum Deposit: $100

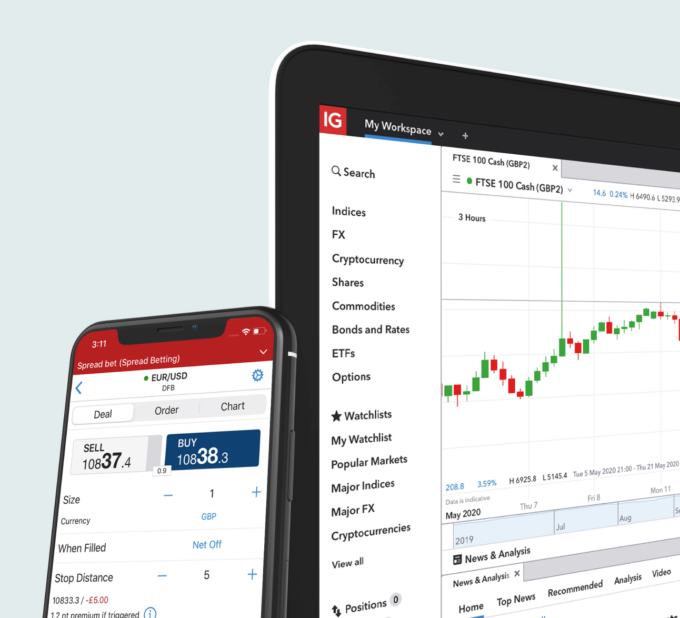

2. IG

An English broker with a very long and respected history in brokerage services which may be tracked to 1974, during the era of gold spread betting.

Today they are also renowned to be a top choice for new traders, especially the ones interested in CFDs and the forex market. In fact, thanks to them traders have access to competitive spreads which start from 0.8 pips.

It goes without saying that, for those interested in scalping techniques (if allowed in their jurisdiction), this may be the best broker to start off with the right foot.

BASIC INFO

- Regulated by: FMA, ASIC, FCA, FSCA, NFA, MAS, DFSA, JFSA, FINMA, BMA

- Trading Platforms Available: cTrader desktop, cTrader web, ZuluTrade, MT4 Desktop, MT4 Web, MT5 Desktop, MT5 Web, MAC Platforms

- Leverage: yes

- Minimum Deposit Required: $250