Learn how to create an LLC Operating Agreement with this step-by-step guide. We offer tips and best practices to help you draft a solid legal document.

If you are starting a limited liability company, one of the crucial documents you will need is an LLC Operating Agreement.

This document outlines the ownership, management, and operation of your business.

In this post, we’ll guide you through the steps needed to draft a comprehensive LLC Operating Agreement that will help ensure success for your business.

We will also answer your questions on whether it is mandatory for your business and when you must create it.

Is an LLC Operating Agreement Mandatory?

An LLC Operating Agreement is mandatory as per the state laws in New York, California, Maine, Delaware, and Missouri.

While most other states do not mandate the Operating Agreement, it is an important step in the process of LLC formation that you should not overlook.

A comprehensive LLC Operating Agreement protects members’ interests and helps prevent disputes by establishing clear guidelines for decision-making and conflict resolution.

And when should you prepare the Operating Agreement?

The LLC Operating Agreement should be drafted as soon as possible to ensure the business has all the rules and guidelines established from the beginning.

In some states, such as New York, LLCs should enter into an Operating Agreement before, during, or within 90 days of filing the Articles of Organization.

8 Steps to Drafting your LLC Operating Agreement

Here are the steps to follow to draft your LLC Operating Agreement:

1. Identify The Members of the LLC

The first step is to identify who the members of the LLC are. The members of an LLC can be individuals, other LLCs, corporations, or other types of entities. Depending on the ownership structure of the LLC, there may be one or more members.

2. Define the Purpose of Your LLC

Clearly define the LLC’s purpose and what it intends to accomplish. You should also list the types of activities that the LLC is authorized to engage in.

The statement of purpose can be a general one, like this:

“The purpose of XXX LLC, is to conduct all business activities legally permitted in the state of ____.”

Some states may require you to create a specific business purpose statement that describes the business activities that your LLC will engage in.

3. Determine the LLC’s Management Structure

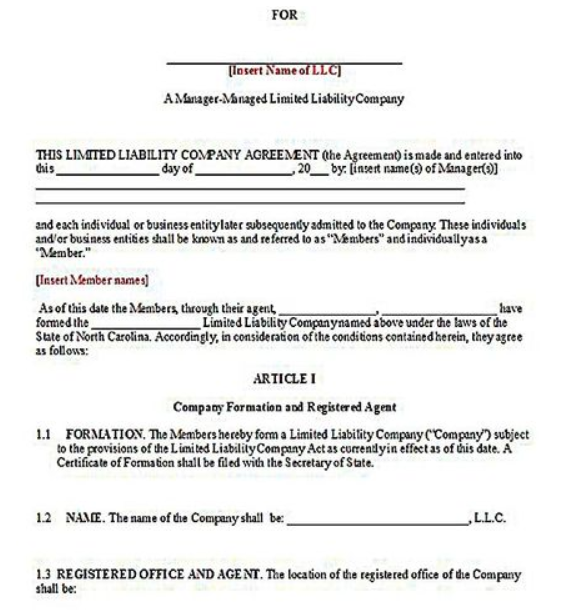

Decide how the LLC will be managed—whether it will be done by its members or by designated managers.

Some LLCs are managed by one or more managers, who are responsible for the day-to-day operations of the company.

4. Determine Ownership Percentages and Contributions

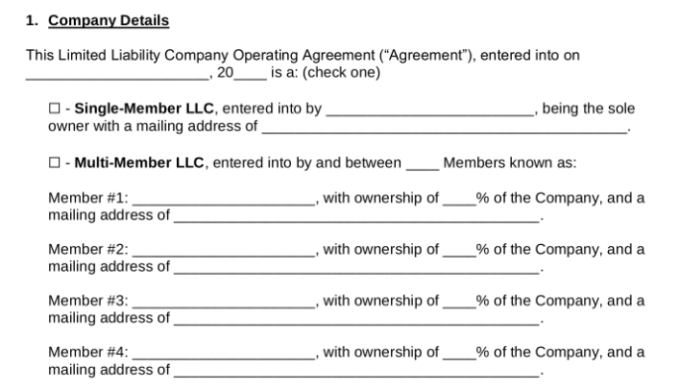

If your business has multiple owners, your LLC Operating Agreements should identify all the members and specify the percentage of ownership as well as the capital contributions for each member.

5. Determine the Roles and Responsibilities of Members

Identify the duties and responsibilities of each member or manager, as well as how they will make decisions and vote on important matters.

For instance, if your LLC is a member-managed business, specify the roles and responsibilities of each member related to:

- Management of the company

- Voting

- Purchase and management of assets

- Refinancing

- Opening and managing of bank accounts

- Appointment of firms, individuals, officers, and managers

- Execution of contracts, leases, franchise agreements, etc.

6. Outline the Financial Structure

Before drafting the LLC Operating Agreement, decide how the LLC’s finances will be managed, including how profits and losses will be distributed among members.

7. Draft the LLC Operating Agreement

While you can create your own LLC Operating Agreement from scratch, there are also templates available, such as the one offered by NW Registered Agent. You can check this NW Registered Agent review by GovDocFiling for more details.

Some common sections to include are:

- Definition of terms and introduction: The LLC Operating Agreement typically starts with a definition of terms and basic information about the LLC.

- Share of ownership: In addition to the ownership share of each member, record the mailing address of each member, as shown in this template below:

- Capital contributions: The next section focuses on the contributions made by each member in a multi-member LLC.

- Management: In this section, describe how the LLC will be managed, including whether it will be managed by its members or by designated managers.

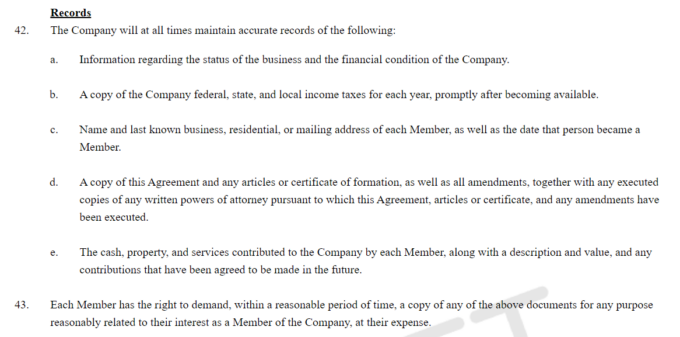

- Records and taxes: Here is a sample of an Operating Agreement that highlights the procedure for record-keeping.

- Meetings: Outline the procedures and requirements for holding annual meetings of the LLC’s members.

- Transfer of ownership: This section specifies the conditions under which members can transfer their ownership interests in the LLC, and how such transfers will be made.

- Liquidation and dissolution: This section should specify the process for dissolving the LLC if necessary.

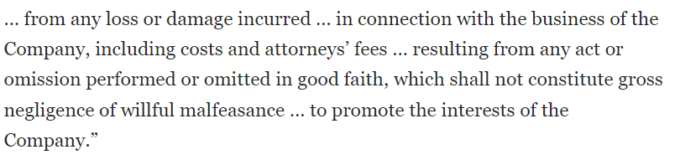

- Indemnification: Indemnification is an important provision that can protect the LLC, its managers, and its members from certain legal claims or damages.

Here’s a sample indemnity clause:

- Miscellaneous provisions: Depending on your business’s goals and procedures, you may need to add provisions, such as dispute resolution methods, the procedure for adding new members, and so on.

- Signatures: The final section of the LLC Operating Agreement is dedicated to member signatures along with the date. The LLC Operating Agreement becomes a legally binding contract once all the members sign the document.

Final Thoughts

An LLC Operating Agreement helps create structure and establish control among members in the business by outlining roles, ownership interests, procedures for decision-making, and more.

Although it can be time-consuming to draft an Operating Agreement, taking the time to get it right from the start can go a long way toward protecting you and your business.

So, go ahead and start drafting your LLC Operating Agreement today to secure your business.