Investment portfolios often encompass a wide range of asset classes, from traditional stocks and bonds to real estate and commodities. However, another category of investments is increasingly being recognized for its potential – alternative assets. Among these, diamonds are emerging as a novel and promising avenue for wealth diversification.

This post aims to explore the reasons why diamonds can be a savvy addition to your investment strategy.

Tangible Asset With Intrinsic Value

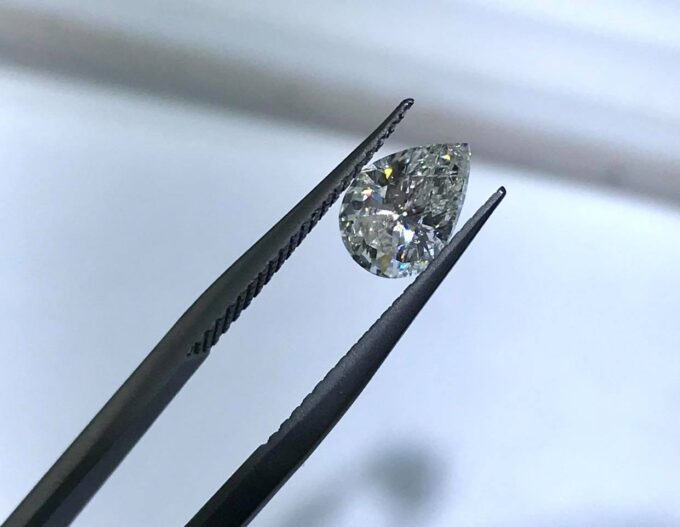

As explained by Diamonds On Richmond, a premier provider of investment-grade diamonds, one of the primary reasons diamonds are attractive as an alternative asset is their tangible nature. Unlike stocks and bonds that are essentially pieces of paper or digital entries, diamonds are real, physical objects with intrinsic value.

Their worth does not hinge on corporate performance or economic cycles, thus they provide a robust shield against inflation or market volatility. In addition, diamonds are compact and portable, making them a convenient store of value that can be kept securely or even transported across borders without much hassle.

Scarcity And Demand

Diamonds are renowned for their scarcity. The dwindling supply of naturally occurring diamonds, paired with the rising global demand, particularly from burgeoning markets like China and India, makes diamonds a compelling investment.

Scarcity creates exclusivity, which in turn fuels demand and price appreciation. Thus, diamonds can not only hold their value but potentially increase in worth over time, making them an appealing asset for long-term investment.

Investment In Luxury

Investing in diamonds is akin to investing in the luxury market. Diamonds, after all, have been coveted for centuries for their brilliance and allure, and their demand in the luxury market isn’t waning. The global appetite for luxury goods continues to rise, particularly in emerging economies where a growing middle class is increasingly disposed to spend on high-end items.

As a symbol of status and wealth, diamonds retain their value even in tumultuous economic times. This resilience makes diamonds a unique asset class that can provide returns and security for investors.

Portfolio Diversification

Diversification is a cornerstone of any successful investment strategy. Adding diamonds to your portfolio can provide a hedge against volatility in traditional asset classes, and offer a level of stability.

Unlike stocks or commodities, diamonds don’t react directly to political and economic events. This non-correlation with mainstream markets allows investors to better spread their risk, providing a safety net during periods of market uncertainty.

Potential For High Returns

While investing in diamonds requires expertise and understanding of the global diamond market, it does hold the potential for substantial returns. Investment-grade diamonds, particularly rare colored diamonds, have seen significant price appreciation in recent years.

It’s critical, however, to consult with experienced gemologists or diamond investment firms to ensure you are buying the right diamonds at the right price. With careful selection and professional advice, diamonds can yield impressive returns over the long term.

Increasing Transparency And Traceability

The diamond industry has made significant strides in improving transparency and traceability, which bodes well for investors. With advancements in technology, such as blockchain, the provenance and journey of a diamond can now be tracked from the mine to the market.

This transparency builds trust and allows investors to make informed decisions, further adding to the attractiveness of diamonds as an alternative asset.

Durability And Longevity

Unlike some assets, diamonds have an enduring quality that adds to their appeal as an investment. They are, after all, the hardest known material on Earth, which makes them resistant to damage or degradation over time. This durability contributes to their lasting value.

As a physical asset, a diamond is something that can be passed down through generations, retaining or even growing in value over time.

Portable Wealth

The small size of diamonds relative to their value makes them an incredibly portable form of wealth. This is a unique advantage compared to other tangible assets like real estate or even gold. In extreme situations, this could be valuable.

For example, if a person needed to leave their country quickly due to a crisis, it would be much easier to carry wealth in the form of diamonds than in the form of real estate or large quantities of gold.

The Rise Of Lab-Grown Diamonds

It’s important to note that the diamond market is evolving, with lab-grown diamonds becoming more prevalent. These diamonds, which are physically and chemically identical to mined diamonds, can be produced at a lower cost and with less environmental impact.

Some investors may see this as a threat to the value of mined diamonds, but others may see it as an opportunity to invest in the companies producing these lab-grown gems.

Impact Of Technological Advances

Recent technological advances in gemology have led to improved grading techniques and detection of lab-created diamonds, making the market safer for investors. Accurate grading is crucial in determining a diamond’s value, and these advancements add an extra layer of protection for investors,

On the other hand, technology has also allowed for better cutting and polishing processes, enhancing the beauty and value of diamonds, thereby making them more attractive to potential buyers.

Investment In Rare Colored Diamonds

Beyond clear diamonds, rare colored diamonds offer an interesting niche within the diamond investment world. Colors like blue, green, and especially pink and red can significantly increase a diamond’s value. For example, the “Pink Star” diamond, a 59.6 carat pink diamond, sold for more than $71 million in 2017.

While colored diamonds are indeed rarer, they can offer an interesting and potentially profitable opportunity for investors looking for unique ways to diversify their portfolios.

In Conclusion

In summary, the benefits of diamond investing extend beyond what’s initially apparent. The emotional appeal, advances in technology, the niche market of colored diamonds, and relatively lower volatility compared to other commodities each add their unique shimmer to the attractiveness of diamonds as an investment asset.

As always, however, these potential benefits should be carefully weighed against the risks and costs associated with investing in such a specialized market. It’s essential to conduct thorough research or engage with experts in the field to ensure that you make informed decisions about diversifying your investment portfolio with diamonds.