Annuities are one of the most important financial products available to Americans. That’s probably why the total annuity sales reached $310.6 billion in 2022, a 22% increase from 2021.

Annuities can help you reach your retirement goals by providing a steady income stream and offering tax benefits. This comprehensive guide will tell you everything you need to know about annuities, what they are, how they work, and how to choose the right annuity for your personal needs.

What Is an Annuity?

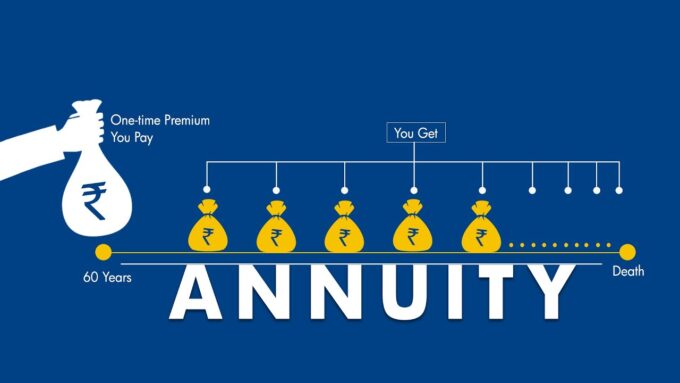

An annuity is a financial product that provides income for the rest of your life. This makes it an excellent retirement plan. An annuity can be purchased in many different ways, and it’s essential to understand the differences between these options so you can choose the one that’s right for you.

Annuities can be used for retirement income and providing lump sum payouts. And as the number of retirees grows, so does the number of annuities as they are reliable as a solid retirement plan. Data shows 3.3 million or 7% more retirees in October 2021 than in the previous year.

If someone wants their money now but doesn’t want to take out another loan or sell their home, they might consider buying an immediate annuity (IA). An IA will immediately give them cash while providing regular payments until death or longer if they decide not to take all their money out immediately.

Types of Annuities

There are several different types of annuities. The most common are:

- Fixed income annuity. This account pays you a specific amount each year, usually for life or a set period, like 10 years. These payments can vary in amount but will not change during your contract term unless you change it. One can open a fixed annuity for approximately $2,500 to $5,000 with regular premium payments.

- Variable income annuity (VIA). A VIA offers a rate of return based on the performance of an underlying investment fund or portfolio managed by a third party, such as mutual funds or stocks and bonds. These investments may pay dividends and/or interest income depending on what types they invest in

- Single premium immediate annuity (SPIA). This type pays out immediately after purchase. You don’t have any control over how much money goes into each payment because all funds go into one large payout at once. According to Forbes, you can opt for regular monthly payments for 20 years. The longer the time, the lower the monthly payout.

How Annuities Work

Annuities are financial products that offer guaranteed lifetime income. Annuities can be structured in a variety of ways, but they all have certain features in common:

- Annuities are most commonly bought from insurance companies or banks. They’re not stocks or bonds. You don’t buy them on the stock market like you would with mutual funds or other investments.

- You pay money into an annuity and receive payments back over time. The payments are usually tax-deferred until withdrawal begins at age 59 1/2, so they grow faster than they would if taxes were taken out immediately every year.

- “Guaranteed” means exactly what it sounds like, your payout will never decrease due to market fluctuations.

Benefits of Annuities

Annuities are a popular way to provide many benefits:

- A steady stream of income. Annuities can be used to supplement retirement income or secure an estate, providing you with a guaranteed monthly payment that can help you live comfortably in your later years.

- Estate planning. An annuity might be suitable if you’re looking for a way to leave behind some money for your family after death. This type of investment allows people who have accumulated wealth but don’t want to give up control over their assets to pass along their wealth while still receiving payments from them themselves.

- Another benefit of an annuity is in reducing the volatility of your investments. Annuity Straight Talk states that annuities secure your retirement savings from market volatility, giving you a proven and secured income.

Disadvantages of Annuities

While annuities have many advantages, they also have some drawbacks.

- You can’t cash in an annuity until you reach the age of 59 1/2. This is called the minimum distribution requirement, and it’s intended to prevent people from using their tax-deferred savings as if they were a regular savings account.

- Annuities aren’t eligible collateral for loans like stocks or bonds are. This limits their usefulness when securing a house purchase or car loan financing. However, if you plan and purchase any asset with cash instead of putting everything into an annuity immediately, this shouldn’t be much trouble.

- Some companies charge surrender charges when customers withdraw funds early. These penalties help protect against people cashing out when markets are low so that everyone else has enough money left over during aftermarket recovery periods without having invested during those times too much themselves.

Annuity Riders

Annuity riders are optional features that can be added to your annuity contract. They can help you customize your annuity to suit your needs and circumstances, such as:

- Tax deferral: Annuities offer tax-deferral options, which allow investors to delay paying taxes on the earnings of their investments until they begin receiving payments. This is especially valuable for high-income earners who would otherwise pay high ordinary income tax rates on these earnings at withdrawal time or when passing away.

- Guaranteed lifetime income: Guaranteed lifetime income riders provide an additional source of guaranteed income beyond what’s provided by Social Security benefits or other sources such as pensions. Bond pools usually back these guarantees. However, some companies may offer them without any backing.

Tax Implications of Annuities

Annuities are taxed as ordinary income, meaning you pay taxes on the interest you earn in a given year. The IRS considers annuity payments to be earned income and must be reported on your tax return.

You can deduct the premiums paid to an annuity contract as long as they don’t exceed the amount of your annuity payments that year. If you’re still paying off a loan taken out when buying an immediate annuity and have no other investment income, these payments might not count toward getting this deduction. Before claiming one, you must check with an accountant or tax preparer.

Also note that even if your premium payments are less than what you receive annually from them, then it’s still possible for some portion of those premiums’ value to be considered taxable income under Internal Revenue Code Section 72(e)(1).

Conclusion

We hope this article has helped you better understand annuities’ benefits. An annuity can be a significant investment, but it is essential to do homework before purchasing one. Ensure you understand how they work and the options available to choose the best one for your circumstances.